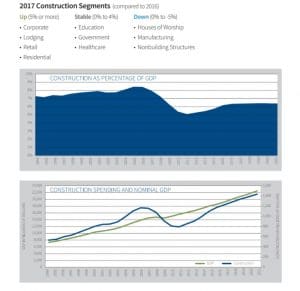

AV systems integrators working in the corporate, hospitality, retail and residential markets could be in for a good year, based on the 2017 NSCA research Electronic Systems Outlook for 2017, which saw those markets grow at least 5 percent in construction from year to year. [related]

Construction in the education, government and healthcare markets were stable in 2017 with 0 to 4 percent growth, while the house of worship market saw a steep decline from the end of 2016 through 2017, according to NSCA’s quarterly report on the health of the market.

“This report makes it easier for members to decide where to focus their efforts,” says NSCA executive director Chuck Wilson.

FMI, which worked with NSCA research to craft the quarterly outlook, predicts a 5 percent increase in total construction spending over 2017 after 4 percent growth in 2017.

According to the Outlook, the construction unemployment rate was slightly above 5 percent for 2017, a bit higher than national average in the 4% range. The Consumer Price Index finished up about 2 percent in the last recorded period—October 2017.

The CPI is a measure of the average change over time in the price paid by urban households for a set of consumer goods and services.

The Conference Board Consumer Confidence Index graph shows that NSCA members still struggle to attract, hire and retain employees at nearly every level, with qualified technical workers and sales professionals are “at the critical stage,” according to the report.

“The low unemployment rate makes it tough, especially when adjacent industries are reaching into our member companies to recruit top talent,” according to the NSCA press release.

“NSCA members that provide traditional AV systems, physical security, alarms, and life safety solutions at low margins are especially vulnerable as we see dramatic compensation differences with building automation and control, MSPs, IT VARs, solutions providers, and bundled services providers. Higher billed rates have allowed adjacent industry competitors to drive up labor costs in businesses that have not prepared for these increases.”

The Electronic Systems Outlook Winter 2017 edition also provides an updated view of construction data by market for electronic systems/technology, including AV, data/IT, building automation/control, life safety/fire/security, and digital signage/lighting.

Economist Chris Kuehl will use the report to analyze long-term trends, current conditions, and the economic outlook for 2018 and beyond as he prepares for his presentation at the 20th annual NSCA Business & Leadership Conference Feb. 28 to March 2 in Dallas.