We talk all the time about how integrators should shift an MSP-type model: that is, a managed-service provider. The trick, though, is all in the transition. If you’re about to alter how your business works, perhaps now is the time to consider how you keep your books. These MSP accounting tips will help you balance your budget and stay ahead of any rough times you come across.

These tips were provided by Rayanne Buchianico, owner of ABC Solutions MSP Accounting firm, who says the thing to focus on whenever you look at your firm’s accounting is: “What question are my books answering?”

- Are you profitable?

- Where are you profitable?

- Do you have too much debt?

- Do you have a cash flow problem?

- Is your business sustainable?

She asked these questions of those in attendance at the recent ASCII Group summit, an event dedicated to MSPs.

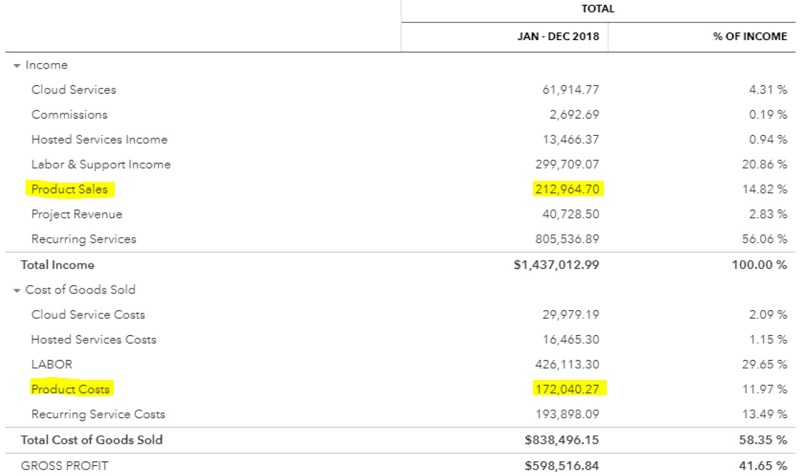

Tip 1 – Gross Profitability

She recommends that you separate your revenue stream into buckets – lining up the costs of goods/services within those buckets with the income of the same goods/services.

If Total Product Sales are multiplied by 0.8, the result should be reasonably close to total product cost.

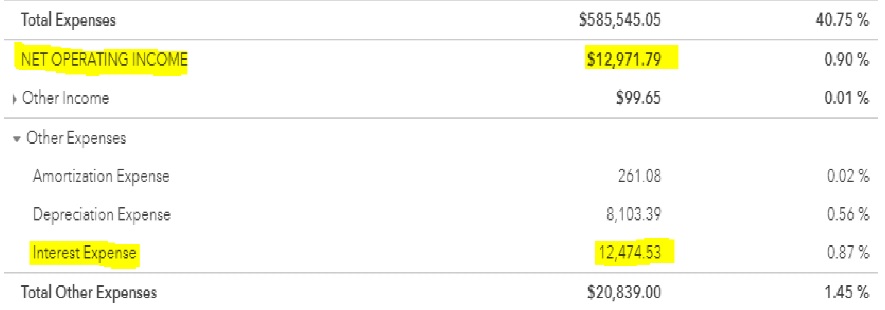

Tip 2 – Debt Usage

Buchianico says it is important to separate interest from operations. Divide operating income by interest expense: higher numbers equates to a healthier usage of debt.

Related: If AV Integrators Don’t Follow These 4 Data Privacy Guidelines, They Should be Held Accountable

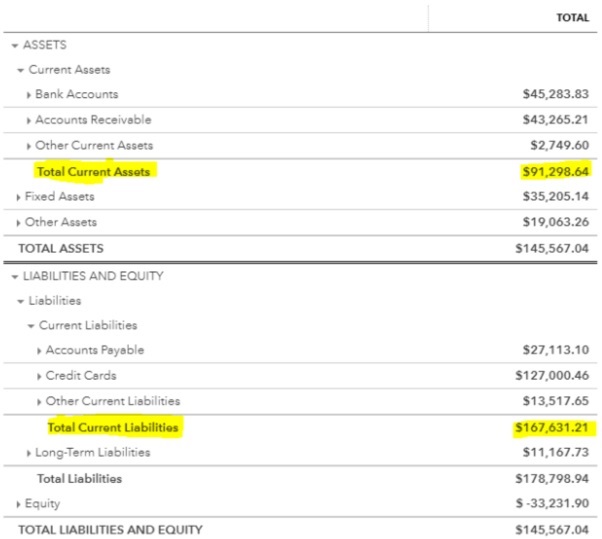

Tip 3 – Liquidity

Divide current assets (money, or items which can turn into money soon) by current liabilities (payments, or things you’ll have to pay for soon): the result is “working capital.” If everything crashes tomorrow, a higher assets to liabilities ratio means you could pay any debts off. You want 1:1 or 2:1 ratio, Buchianico says.

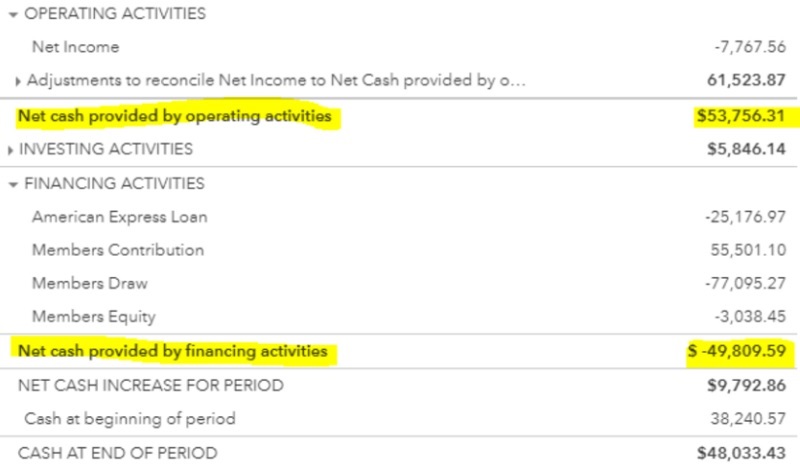

Tip 4 – Cashflow

It is critically important to keep track of where you are spending money. The above example clearly illustrates a situation Buchianico described as a “classic example of a CEO using business funds to pay for shifting personal expenses.” The tell is the heavy draws from financing.

Tip 5 – Profitability

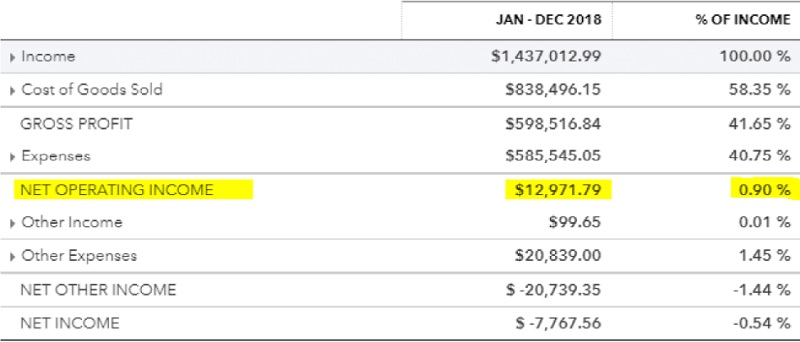

Net income should always be a minimum of 10 percent gross revenue, Buchianico says.

Key MSP Accounting Takeaways:

- Focus on critical areas immediately

- Make long term plan to improve company’s financial health

- Measure EBITDA over time

- Arrange COA to provide easy access to financial information