Video walls and digital signage technology may be the most prominent technologies in the AV industry.

Even for those who aren’t aware that integrators exist, video walls and digital signage are everywhere around them.

Large venue sports arenas, digital billboards on metropolitan streets and highways, malls and retail spaces, college campuses and corporate lobbies—video walls and digital signage are everywhere.

Obviously, that presents a number of opportunities for integrators.

When you speak of the “V” in “AV,” it’s likely that a large video wall is the first thing that comes to mind.

Electricians and architects would be ill-fitted to install these often–complicated designs.

It takes an integration firm with the right experience and training to get these implementations working.

The same can be said for digital signage, especially centrally managed systems that need to push content to multiple displays across a building, multiple buildings, or even disparate locations all over the world.

We decided to survey our integrator audience to learn more about the current state of video wall and digital signage installations in the industry.

Before digging deeper into the numbers, it’s important to note who integration firms are selling video wall and digital signage technology to:

- The most typical decision–maker is an owner/executive, according to our respondents, 41% of which said that is who they most often sell to

- 23.1% say that a department manager is the most typical decision maker they sell these solutions to

- The rest of the respondents were split, with 17.9% each saying that IT professionals or facilities managers were the most typical decision maker client.

There is also an opportunity to keep in mind, regardless of who integrators are selling to.

Only 34.6% of integrators are selling content packages to customers when they install video walls or digital signage, meaning almost two-thirds are not selling content packages.

Something needs to be on the screen, so why not provide that content along with the system? This could even be a recurring revenue play, with integrators managing the content creation and distribution process.

Keep both the typical decision–maker and the opportunity around content management in mind while we discuss the specifics of our findings.

Video Wall Technology by the Numbers

While LCD technology has dominated the video wall market for many years, LED has made a strong push and has begun to take over the top spot when it comes to video walls.

The most obvious benefit of LED is that it offers an experience free of bezels. Integrators are finding that, when given the choice, customers prefer to have no seams on their video walls. LED also offers brightness levels that can fit in environments with ambient light.

The biggest draw, perhaps, is that LED offer flexibility in design that simply cannot be matched by LCD technology. LED video walls can be designed to fit around corners and columns, to be fit onto ceilings and floors, and to be shaped in ways outside of the traditional rectangle customers are used to.

The prevalence of LED technology is reflected in our survey.

When asked which type of video wall is most requested by customers, LCD or LED, almost 80 percent of respondents said that LED is most requested.

Whichever technology is being used, our survey results suggest that the vast majority of video wall systems are going into corporate environments.

79.5% of respondents have implemented video wall technology within the past year.

That’s followed by education environments, government environments, and healthcare environments.

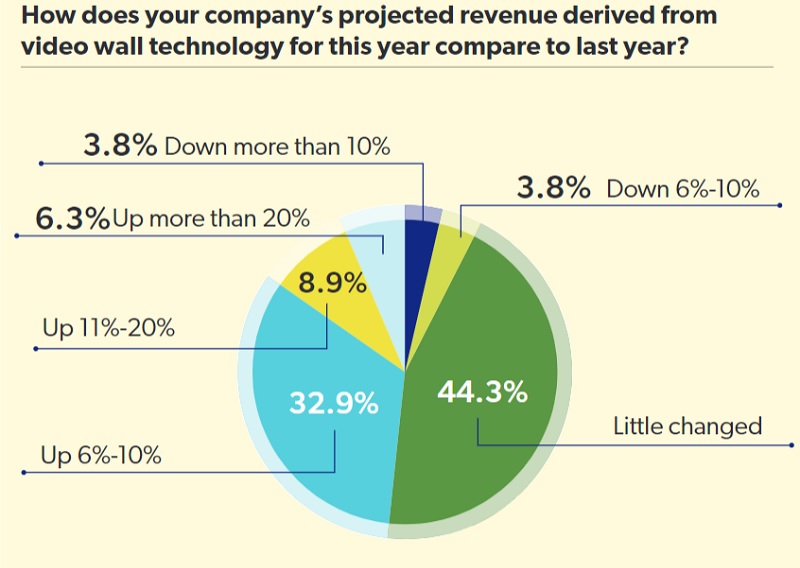

The market for video walls is a healthy one as well. 48.1% of respondents have a higher projected revenue derived from video wall technology this year compared to last.

About 44.3% say little has changed in terms of revenue, and only 7.6% say that they are down in revenue from video wall technology this year compared to last year.

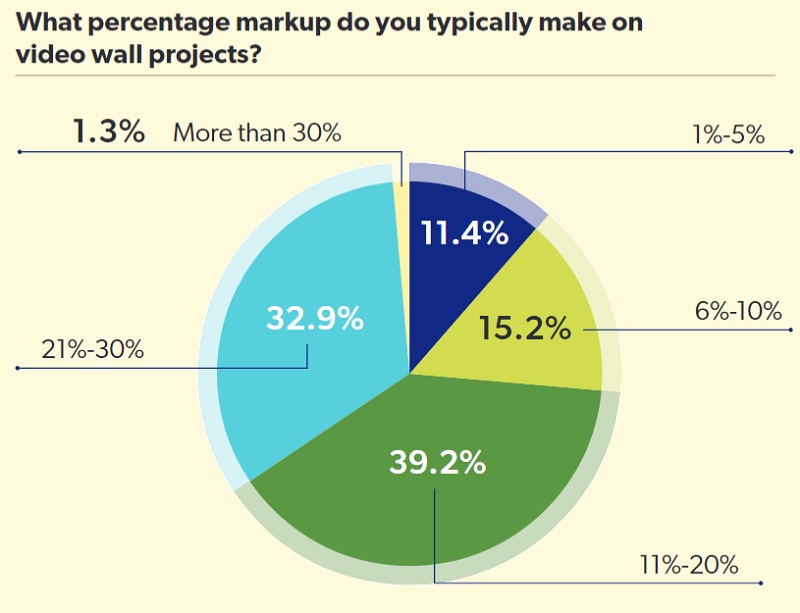

On average, our respondents are installed 12 video wall projects last year. The markups on these projects are typically more than 10%, with 73.4% of respondents marking up video walls 11% or more.

On average, our respondents only implemented content management systems along with the video wall systems 13% of the time.

The numbers paint the picture of a healthy video wall implementation market. Revenue for this year is expected to exceed revenue from last year on average. The average video wall project is an LED installation done in a corporate environment.

Markup is healthy on these systems, though that makes sense as video wall implementation is typically a more large-scale project.

Integrators should pay attention to the fact that content management systems aren’t often installed with video wall projects.

Tie that back to the lack of content packaged being offered, and there is a potential missed opportunity.

When installing video walls, integrators should make sure to discuss the customers’ plan for content on the screen.

Without the right content the video wall is an expensive decoration, when it could be a branding tool, event marketing platform, customer recruitment device and so much more.

A dynamic content management system can help customers easily switch between many different uses for video walls. They can schedule content and push it out remotely depending on what they want the message to be. Integrators can help them by offering packages to develop the right content for different purposes, or even manage the content for them.

The video wall market is a healthy one, according to our respondents. Integrators should be thinking of ways to build on that momentum and upsell customers on complementary technologies that they’ll need alongside the video walls.

Digital Signage by the Numbers

Digital signage is undoubtedly in the same family as video walls when it comes to digital signage technology.

To be clear, when we say digital signage, we’re talking about displays used for messaging, versus displays used for conferencing and collaboration, although conferencing and collaboration displays, when not in use, can certainly be utilized for general digital signage purposes too.

The race between LED and LCD is still tight in the digital signage race, with 48.7% of respondents saying that the most requested type of digital signage is LED, and 42.3% saying LCD is most requested.

When it comes to where these digital signage solutions are implemented, corporate is again the heavy favorite. For digital signage, however, education, healthcare, and retail environments have been more active areas in the past year according to our respondents.

On average, our respondents have integrated 11 digital signage projects in the past year. That could be anything from a single display to more sophisticated, multi-display systems.

When it comes to implementing a content management system, its more often that integrators are including content management systems with digital signage than with video walls.

Our survey says that 35% of digital signage projects are installed with such a system.

Markup for digital signage projects are pretty similar to those for video wall projects. 70.7% of our respondents are charging a markup of 11% or more.

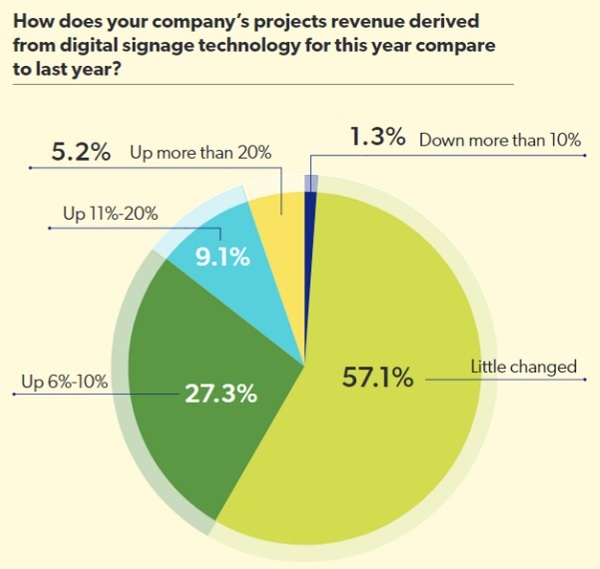

Revenue outlook, however, is even healthier for digital signage projects, with 41.6% of respondents expecting higher revenue for digital signage this year compared to last year and 57.1% expecting little to change and only 1.3% expect to make less from digital signage this year than they did last year.

Digital signage offers more flexibility than a video wall, as the same messaging can span entire office buildings where a video wall lives in a central location.

Digital signage solutions often provide various dynamic content – weather updates, social media feeds, and more.

As a result, there is even more of an opportunity for potential content management systems to add on to projects, and for content management opportunities.

The markets for video walls and digital signage are both strong, particularly in the corporate space. Revenue is expected to continue to grow.

Content management systems, and offering content packages to customers, are two underutilized areas that integrators can focus on to improve their already steady influx of video wall and digital signage projects.