Commercial Integrator recently partnered with ADI Global Distribution, a Resideo company, to survey the integration channel. To ensure unbiased results, we kept private the participation of ADI, a leading wholesale distributor of low-voltage audiovisual and security products. The results, which reflect the candid thoughts of well over 100 integration professionals across channels, provide key insights into both business operations and technology trends. For example, the survey asked about labor-related issues like hiring and subcontracting; proportionality of work across categories like commercial, security and residential; and emerging opportunities in buzzworthy technology areas (e.g., AI, direct-view LED). Here, we offer a summary of our survey results, while also reflecting on their implications for integration businesses like yours.

Hiring Difficulties, Talent Shortages

Hiring difficulties and talent shortages are so frequently discussed in integration circles that the conversation has become almost cliché. But, in a tight labor market and amid upward pressure on wages, those conversations are happening for a reason. So, we asked integrators which skill(s) they’re currently looking for when hiring an AV technician. Here, we see the collision between “traditional” integration and the IT/networking-centric projects of the present. Although 64.1% of respondents say cable pulling/low-voltage wiring is a critical skill, a virtually equal 63.1% identify networking as an indispensable competency. And, reflecting the shift toward more software-driven systems, 52.4% of respondents call programming a must-have skill. Although having competency in rack dressing (47.6%) and commissioning (44.7%) remains important, they fall further back on the list. Among write-in answers were the following: customer service, customer-facing skills, positive mental attitude and rigging.

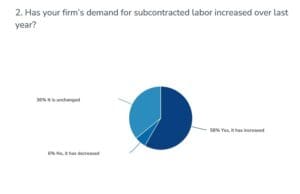

The aforementioned talent-related issues that integrators must grapple with have inspired many to consider subcontracted labor. To try to quantify that, our survey asked respondents whether their firms’ demand for subcontracted labor has increased over the last year. Unsurprisingly, nearly six in 10 (58.3%) report a year-over-year increase in subcontracted labor demand. Perhaps more telling is that a mere 5.8% testify to a year-over-year decrease in demand. The remaining 35.9% of respondents indicate unchanged demand for subcontracted labor. The benefits of leveraging subcontracted labor are multiple, including integration businesses being able to burn through more backlog more quickly, thus boosting revenue potential. What’s more, specialized subcontractors often introduce distinctive skill sets that might exceed an organization’s own abilities in certain areas. Plus, project-specific subcontracting can keep an integrator’s overhead in check at a time when labor rates remain high.

Intermingling of Technology Trades

Next, the survey asked integrator respondents to break out their installation projects (by percentage) into a series of categories. The answers attest to a continuing intermingling of technology trades — an overlap among one-time “non-overlapping magisteria.” On average, 55.2% of respondents’ projects fall into the pro AV/commercial AV category, with 88 respondents reporting a percentage above zero. The runner-up was security, whose 30.7% average response takes second place. Some 66 respondents indicated that some percentage of their projects center on security technology. Other categories, such as IT/networking (17.1%), residential AV (15.7%) and structured cabling (14.4%), are far behind in the average percentage of installation projects. Nonetheless, in each of those categories, 60-plus survey respondents registered a non-zero answer for project percentage.

Next, we offered respondents an opportunity to write in a project category that we might have overlooked. We received many responses, although some seem like subcategories to the more inclusive groupings above. For example, four respondents put digital signage, although many would consider indoor and outdoor signage, as well as video scoreboards, part of the pro AV/commercial AV category. Other respondents wrote in subcategories like lock and door installations, CCTV and access control, although many would group those into the security category. Other responses include life/safety and fire alarm, software development, lighting design and controls, and analytics-based software and services.

The fifth question, which asked integrator respondents to rank which technologies represent the biggest opportunity area in 2024, is among the most interesting. As options, we presented three buzzworthy technology categories in integration circles: AV-over-IP/network-based systems, direct-view LED (DVLED) and artificial intelligence (AI). The clear winner is AV-over-IP/network-based systems, earning a composite score of 225. This reflects the emergent ecosystem-based approach to integration, which finds AV technology comingling with IT technology and utilizing IP infrastructure for transmission throughout facilities.

Networking Knowledge Rapidly Increasing

Integrators’ networking knowledge is rapidly increasing. (For proof, turn back to the first question, whose results attest to high demand for networking skills.) But this interest level perhaps also presents an opportunity for subcontractors. An integration specialist who finds a partner or subcontractor whose foundational competency lies in IT technology and networking will likely enjoy greater efficiency and increased project profitability. For their part, DVLED and AI earn composite scores of 182 and 170, respectively. AI coming in third probably has to do with integrators — indeed, all of us — continuing to try to ascertain where the opportunity lies, what’s just hype and whether risks are overstated.

Next, we asked integrators to identify any key opportunity areas we did not offer as options. Respondents submitted dozens of answers, with few clear similarities among them. Access control appears twice, reflecting an interest among both security specialists and ancillary-opportunity-minded AV integrators. Digital signage, likewise, appears more than once, with one respondent pinpointing digital video scoreboards as an especially opportune category. Other answers include the following: spatial audio, projection mapping, wireless/Bluetooth VoIP, golf simulators, wireless audio systems and cloud storage. One respondent’s extended answer is illuminating. They write, “Even though VTC/conferencing/collaboration has been around for ages, it’s still benefiting from the pandemic bump and expanding well beyond what we saw pre-COVID. So, I’d say that’s still a pretty big opportunity area.”

Applications and Use Cases

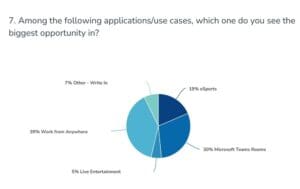

Continuing our focus on opportunity areas, our next question asked about applications and use cases of increasing interest to integrators. Aligning with the respondent’s quote above, we find 39.2% of survey takers call the work-from-anywhere movement the single ripest application for profitability-minded integrators. This reflects a pandemic-born desire to collaborate and conference outside the four walls of a communal office. However, even work-from-anywhere exponents recognize that, for certain tasks, coming into the office continues to make sense. Thus, it’s not surprising that the second-place finisher is Microsoft Teams Rooms, which earn 29.9% response. Our collective standards are now higher, and we expect organizations to “earn the commute.” Microsoft Teams Rooms can prove transformational for meeting spaces. The other answer options — esports (18.6%) and live entertainment (5.2%) — register comparatively less integrator interest. Write-in responses include the following: houses of worship/churches, education, huddle rooms and drone detection.

The final survey question asked integrators for the most important problem in their organization that they’re trying to resolve. Talent and labor are consensus top-tier issues for our integrator respondents. One survey taker bemoans the lack of a labor pipeline. They write, “[There’s] no easy entry point for young people — or anyone, for that matter — wanting to get into our industry. [There are] few trade schools. [There is] even less online generic training material.” Another respondent candidly admits, “We are struggling to find experienced AV professionals in nearly all categories.” Another respondent points to having difficulty hiring and training field engineers to close out and commission spaces effectively. They write, “The wave of backlog equipment from all of the manufacturing delays is now crashing.”

Simple But Commercial Grade

Other survey takers discuss the dueling imperatives to keep systems simple while, at the same time, reinforcing the value of professionally installed, commercial-grade gear. One respondent speaks of the need to keep advanced systems understandable to the end user. They write, “The complexity of AV systems is such that it is hard for the end user to stay current and keep system settings from drifting to less-than-ideal settings.” The answer may be to integrate systems whose user interfaces are sufficiently simple that users won’t feel the need to plug/unplug cables or press extra buttons. Another survey taker articulates the plain truth: Simple, but high quality, systems come at a premium price point. “[We must educate] them on the actual costs of gear, and therefore the functional differences between consumer and secure commercial products,” they say. “Sorry, man — it costs what it costs. And don’t try picking up a Costco/Staples/Walmart sale special, because none of them are approved for secure spaces!”

This snapshot in time of the integration channel in Q4/23 reflects several challenges but abundant opportunity. It also illustrates how key strategic partnerships, such as working with a wholesale distributor with strength in both AV and security, such as ADI Global Distribution, can provide a competitive advantage to profitability-minded and growth-oriented integrators.

This piece is proudly sponsored by ADI. ![]()