In late January, a new word burst through in our monthly pro AV industry pulse check: tariffs. President Donald Trump was in office again and making new taxes on imports a central focus of his new term. This shouldn’t be too surprising: During the campaign, he made trade and tariffs the second point on his website’s issues list. In addition, he made numerous strong statements, such as “We are going to be a tariff nation.”

In his presidency so far, we have seen new tariffs or threats of new tariffs on China, Canada, Mexico and the EU (among many other countries, as well). These geographies are the U.S.’s top trading partners, so the impact of such tariffs would be substantial. In addition, President Trump has imposed new tariffs on steel and aluminum, as well as their derivatives. Add in that countries almost always respond to tariffs with counter tariffs, and there’s a reality our industry must face: It’s time to prepare for tariffs.

In AVIXA’s most recent Macroeconomic Trends Analysis (META) report, we went deep into tariffs and what they mean for the pro AV industry. (The full report is available to AVIXA Silver and Gold members here.) The report covers the status quo, a brief Trump tariff history, and why we see preparation as critical to success during this second Presidential term. It also explores data on how the pro AV industry is preparing — more on this in a moment — before going into detail on strategies to minimize tariff exposure. There are lots of countermeasures for businesses, though they tend to get quite complex quite quickly.

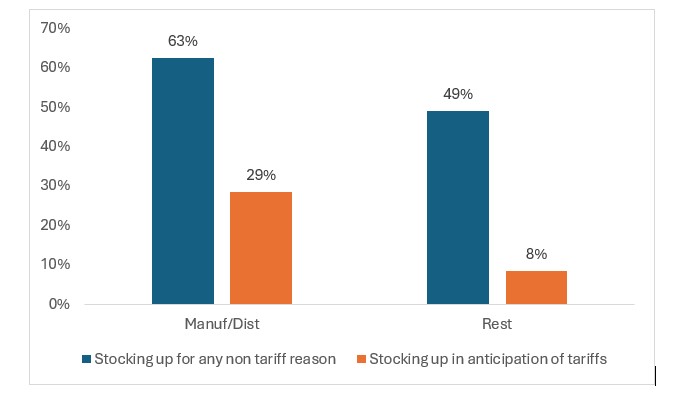

Our data collection in January on industry preparations showed several interesting findings. Stocking up is a basic but important part of the formula — at least for now. In Figure 1, we show the proportion of companies stocking up in anticipation of tariffs vs the proportion that is stocking up for any reason (i.e., because they have contracted work). A minority of companies are stocking up due to tariffs, though the percentage is much higher for manufacturers/distributors than it is for the rest of the industry.

Figure 1. Stocking up in Anticipation of Tariffs vs. Stocking up for Non-Tariff Reasons

Strategies to Minimize Tariff Exposure

Stocking Up

For those in the AV industry community, stocking up before new tariffs hit is the easiest way response, though it has drawbacks of additional warehousing and financing costs, limited long-term viability, as well as uncertainty that whatever tariff finally happens may not match what you expect.

Buy Domestic

Buying domestic — the other obvious tariff response — is theoretically great, but in practice often difficult. For one, in pro AV, there may not be a domestic source for a given product. If there is, it may not be as tariff-independent as you think: Its raw materials or components may be subject to tariffs, increasing its final cost. Even if the products materials, components, and manufacturing are all domestic, its price could go up when everyone has the tries to buy from the limited domestic sources.

Location of Value Creation

There are many other ways to avoid tariffs, though they get increasingly complicated. The full report covers much more, but here, we’ll focus on the most conceptual one: Adjust the location of value creation. Let’s consider a product that is made in China and shipped to the U.S.: If it is wholly made by a Chinese manufacturer and purchased by a U.S. buyer, the tariff applies to the transaction price (pending perhaps a shipping detail or two). But if it is made in China by a multinational company, things can get complicated.

The price of a good includes of course the labor and supplies required to build it. But it also includes the product design, marketing and things like support and warranty. These latter components could potentially be done in-country, making a lower percent of the final price subject to tariffs.

Product Selection

As well, product selection will affect tariff risk. For example, a traditional flat panel display exits the factory essentially complete, with limited installation needed. By contrast, direct view LED (dvLED) displays require significant time and skill to install. That substantial installation cost necessarily happens in-country, fully independent of tariffs. So, tariffs will incentivize a shift towards products where a significant portion of their final cost happens in country like dvLED.

Turning Tariff Challenges into Opportunities

Right now, we’re at the tip of the iceberg, both in terms of what we’ve covered here on how AV companies can minimize their tariff exposure, and in terms of the Trump presidency. It’s the first couple months of a 48-month term!

Here’s the reality: Tariffs will be a challenge. But when a challenge comes in the form of increased difficulty rather than decreased demand, that challenge is actually an opportunity for smart businesses. While tariffs will reduce demand for certain products in certain geographies, we ultimately see it primarily as a source of extra difficulty. That means that if your company gets its response right, the added difficulty will be your gain.

Peter Hansen is economist at AVIXA.