Gone are the days of command centers being reliant solely on radios and static maps. Today, AV technology transforms these spaces with dynamic data visualization, seamless communication interfaces and immersive training modules. These mission-critical centers encompass a wide array of industries including energy, utilities, transportation, public safety, local government and healthcare. This market is traditionally focused on applications such as network operations centers (NOCs), security operations centers (SOCs), DOT traffic centers and utility control rooms. However, today’s command-and-control room projects also encompass social-media monitoring centers, hospital operations, experience centers and manufacturing sectors. Integrators need to deliver tailored, innovative solutions to meet diverse operational needs.

Drawing on insights from well-versed AV industry experts, Commercial Integrator’s Command-and-Control Deep Dive seeks to paint a timely picture of the future of this burgeoning market. CI presents fresh data from our exclusive research study. Moreover, we share perspectives from several technology thought-leaders: Sean Wargo, vice president of market insights, AVIXA; Charlie Marchand, project manager, systems integration, Solotech; Robert Cameron, vice president of control-room solutions, CTI; Robert Henze, vice president, command and control, Visual Sound; Dalton Parker, director of sales and marketing, TVS Pro; and Tyler Bonner, senior vice president of, mission-critical environments, Diversified.

Growth Forecast

The command-and-control market is rapidly evolving with real-time data visualization, AI-driven analytics and predictive technologies enhancing decision-making processes. The rise of immersive and interactive AV solutions is driving the need for sophisticated AV integration, positively impacting revenue by creating demand for advanced, customized AV systems.

Integration firms, such as CTI are deeply investing in R&D with key tech partners to strengthen operational strategies across various control center environments. Robert Cameron, vice president of control-room solutions at CTI, shares, “By leveraging AI and machine learning, we reduce inefficiencies and open new revenue opportunities. AI’s impact goes beyond workflow performance and revenue; it revolutionizes customer experiences, data analytics and process automation. This technology promises to be one of the most significant advancements in history, far surpassing previous innovations like fire, flight and the internet.”

Sean Wargo, senior director of market intelligence for AVIXA, says, “According to AVIXA’s latest industry forecasts (IOTA), command-and-control solutions generated $17.8B in revenues in 2023, growing 5.3% over 2022. The last few years of growth have been slowing as the industry comes out of the pandemic recovery period. This means, in general, we are returning to more ‘normal’ pre-pandemic growth rates. However, it also reflects some headwinds from high inflation and interest rates that cause companies to pump the brakes a bit on any new CapEx investments. For integrators, this may mean a longer sales cycle as a buyer decides how to best prioritize the spending and determine financing vehicles.”

Wargo continues, explaining, “Control rooms remain a good solution area for integrators due to the most mission-critical nature of them to the business. Further, they are often complex solutions, which marry together the best of both IT and AV components, requiring a broad swath of expertise, including the competencies offered by integrators. And further, they are not just about the technology; they are about the best use of content, tech and spatial configuration, thereby also requiring design and integration.”

“The counterpoint is that control rooms are also democratizing and de-centralizing,” Wargo adds. “While this can mean more volume in project work, it can also mean simpler, [more] cost-effective and, thus, lower-margin projects. Including these smaller control rooms is why our total addressable market figure is larger than others who may be tracking the space. It’s also why we put the five-year CAGR for command and control at 5.24%, which is just below the average for the industry as a whole.”

In Commercial Integrator’s research study of integrators who work in command and control found that they report widely varying average gross revenue for command-and-control-related projects. Approximately 31% of integrators report that they generate $100,000 or less in gross revenue from projects in this category; another 41.4% report that their average gross revenue falls between $100,000 and $1 million. Finally, around 27.5% percent of integrator respondents report that their average gross revenue for these projects exceeds $1 million.

The growth forecast for command-and-control-related projects over the next 12 months from our survey respondents shows diverse expectations. About 25.9% of respondents anticipate no growth, while 17.2% expect a modest increase of 1% to 5%. Growth projections between 6% and 20% account for 24.1% of responses. Higher growth rates, ranging from 21% to 50%, are expected by 20.6% of respondents. Significant growth, above 51%, is anticipated by 10.3%, with only 1.7% expecting their revenue to more than double. A small minority, 1.7%, foresees a decline.

According to Dalton Parker, director of sales and marketing at TVS Pro, “In recent years, our command-and-control-related business has experienced significant growth across diverse verticals. This expansion is driven by the increasing demand for network operations centers and the modernization of existing systems. Advances in DVLED technology have played a pivotal role in lowering total cost of ownership and operational expenses compared to traditional solutions like projection or tiled LCD panels. This trend underscores substantial opportunities for integrators to capitalize on emerging technologies and expand market reach.”

However, Wargo foresees regional variances when it comes to control-room market growth. “AVIXA’s quarterly demand studies (MOAR), provide data showing that control rooms are a particularly high priority for investment in countries who tend to focus more on security and surveillance activities. This includes China, where control rooms are the top priority for investment by buyers. Further, regional conflicts are also spurring additional investment in military, which also translates to operational support through control rooms. While these are longer-term projects, they do contribute to the mid-level growth expected by this solution area over the next five years. They may even represent an upside potential, particularly for those companies with better access to the resulting opportunities. For others, the smaller distributed projects may be a way to build and prove competencies for a later larger project.”

According to AVIXA’s latest industry forecasts, command-and-control solutions generated $17.8B in revenues in 2023, growing 5-3% over 2022. In general, we seem to be returning to more normal, “pre-pandemic” growth rates. Photography by Nathan Morgan via Diversified

Primary Challenges

Integrating AV systems in command-and-control environments presents several challenges. Charlie Marchand, project manager, systems integration at Solotech, highlights the need for seamless system integration, while maintaining high cybersecurity standards; designing robust yet user-friendly systems to prevent downtime; and creating scalable, futureproof solutions considering software versioning impacts. CTI’s Cameron adds, “Managing and harnessing vast sets of big data presents a primary challenge for us. It’s not just about integrating these data streams; it’s about configuring them to fit seamlessly into operations centers. Our goal is to ensure they’re not only manageable but also optimally utilized for their intended purposes.” Operating in dynamic environments that require 24/7/365 availability adds complexity to project planning and execution. To mitigate this, CTI conducts in-depth discovery sessions with end users to anticipate future needs and tailored solutions. The systems deployed must evolve with the needs of the client over time. According to Diversified’s Tyler Bonner, senior vice president of mission-critical environments, the client’s lack of awareness of available technology, best practices and impacts on operator performance is a frequent hurdle. The education process is crucial to helping them make informed decisions, especially because the operators — “the players on the field” — are the ones to suffer the consequences of poor purchasing choices.

Approach to Command-and-Control Projects

Our thought-leaders all agree that their approach to these environments has evolved. Diversified’s Bonner explains, “When you hear network operations center (NOC), the first thought is usually videowalls — how do I sell the customer the biggest wall possible? That is until you really work around these spaces and realize that lives can be drastically impacted by the design within these four walls. That’s when our role [as integrators] takes on a whole new meaning. For me, seeing technology fail for a 9-1-1 operator was a pivotal point in my own pathway in this space. It could have been a loved one of mine who that 9-1-1 operator was aiding. It’s a selfish thought, but it’s what has become the single most important element in our design for control rooms. How do we make the operator better?”

TVS Pro’s Dalton and CTI’s Cameron both emphasize a shift towards prioritizing operational objectives in command-and-control environments. “Our focus is on enhancing functionality for mission-critical operators and reducing inefficiencies,” says Cameron. He adds, “Incorporating advanced technologies like AI-driven analytics has improved predictive capabilities and decision-making processes.” Parker says, “We’ve evolved to design systems that minimize downtime during upgrades, ensuring operational continuity. This balance between advancing AV technologies and maintaining uninterrupted operations boosts overall efficiency and reliability.” Solotech’s Marchand underscores a data-driven, client-focused approach, tailoring solutions to each client’s unique challenges. “Advances in technology and a deeper understanding of user needs allow us to create more impactful command-and-control environments,” she explains.

But how, exactly, are integrators ensuring continuity? Our thought leaders all agree on what’s necessary to maintain system reliability and uptime in mission-critical command-and-control environments: It requires implementing redundant systems, failover mechanisms and vigilant proactive monitoring. It also requires regular maintenance and real-time monitoring to detect and address issues before they escalate. Integrators’ commitment extends beyond deployment, encompassing around-the-clock support and maintenance services.

“To mitigate risks further,” Cameron says, “we meticulously plan and collaborate closely with IT teams. This includes segregating control-room solutions from enterprise network infrastructure. This proactive measure minimizes downtime and safeguards continuous operations, underscoring our dedication to uninterrupted service delivery.”

To ensure seamless integration between AV systems and other critical components of a command-and-control center, integrators engage in thorough planning and collaboration with IT and communication teams. Solotech’s approach uses standardized protocols and involves comprehensive testing to ensure compatibility and effective communication between systems. Mockups and simulations help tailor solutions to specific needs, while phased implementation and rigorous testing mitigate disruptions. CTI prioritizes building trust-based partnerships with stakeholders, setting up separate AV networks, and maintaining clear communication and coordination among multiple departments. Physical network segregation and close collaboration with IT administrators ensure system integrity and security, preventing vulnerabilities and ensuring smooth operation.

Control rooms’ mission-critical nature makes them an appealing opportunity for integrators. Courtesy / TVS Pro

Cameron adds, “For example, by closely coordinating with clients’ IT teams, we successfully integrated our AV systems with their existing data management infrastructure, enhancing operational efficiency and reliability. Early communication of IT requirements and a deep understanding of customer IT protocols are pivotal in navigating this collaborative journey effectively. This proactive engagement not only aligns technical specifications but also fosters a cohesive working environment that supports sustained project success.”

TVS Pro’s Dalton adds, “Our system designs often incorporate physical network segregation or devices with dual network interface cards (NICs) to maintain system integrity and security. This allows a quick single point of entry that can be physically or virtually severed from a compromised network. Constant involvement and collaboration with IT and communications administrators is a key component when working through command-and-control applications to ensure there are no surprises or unknowns when devices are going online during implementation phases. Without a clear understanding of how the AV devices need to communicate, what network rules need to be in place and what network traffic is to be expected, the system will be vulnerable to outside attackers or shut down by internal security measures put in place to mitigate network risks.”

Cybersecurity

In every project, cybersecurity concerns loom large. In regulated spaces, such as command-and-control centers, meticulous planning is essential to support visual networks and maintain secure operations. Solotech’s Marchand emphasizes the integration of robust security protocols and encryption standards to protect sensitive data, ensuring compliance with the highest security standards and continuously updating measures to counteract evolving threats.

Data security is of paramount importance in a control-room setting, adds Wargo. He notes, “This is made more complex and impactful by regulations requiring clear protection, with attributed liability to all of those involved in a solution set. The EU in particular is the most progressive in this area with new regulations already in place and others likely to emerge across its countries. Integrators would be well advised to consult experts to help them best understand their own requirements and potential liabilities.”

CTI’s Cameron adds, “Cybersecurity is a foundational building block in all of our AV integration system designs and projects, regardless of vertical market; in mission-critical command center spaces, we ensure not only solutions but also our people implement robust security measures. This includes secure network architecture, encryption and regular security audits. Compliance with NERC CIP best practices is maintained rigorously. In recent projects, collaboration with clients’ cybersecurity teams ensured our AV systems met stringent security requirements and regulatory standards. For example, in the power utility market, strict adherence to NERC/CIP compliance is mandatory. And for Department of Defense projects, zero-trust policies must be integrated across architectures, systems and processes, addressing requirements within staffing, training and professional development.”

Designing control rooms isn’t just about installing videowalls. It’s about reliable technology to support critical operations. Courtesy / Visual Sound

Ergonomics

When it comes to ergonomics, the operator’s experience should be center stage. “If there is any other starting point, your main concern is no longer related to ergonomics,” quips Robert Henze, vice president of command and control, Visual Sound. Stress, poor performance, fatigue and low alertness are just a few of the dangerous outcomes that can result from implementing an inadequate control-room technology solution. Integrators need to prioritize operator comfort, well-being and user-centered functionality. CTI’s Cameron adds, “We meticulously engineer operator workstations and control interfaces to prioritize comfort, efficiency and intuitive usability. Every detail, from environmental factors to viewing distances and angles for videowalls and visualization systems, is meticulously calculated to minimize operator strain.” Solotech’s Marchand agrees, “We design interfaces that are intuitive and user-friendly, reducing the cognitive load on operators. Ergonomic considerations include the placement of screens and controls to minimize physical strain and enhance workflow efficiency, ensuring an optimal user experience. We also focus on creating interfaces that are easy to navigate and operate under stress.”

Diversified’s Bonner adds, “It’s all about the operators working in the space. Technology becomes a substantial variable in the overall design, but the design of the physical space centers around those operators. These aren’t meeting rooms and can’t be treated as such. The furniture, layout of the desktop, access to the necessary data and intercommunication of the operators within the room are all driving factors that influence design. It’s all about making the operator more effective. That’s where the design starts.”

Videowall Technologies Commonly Deployed

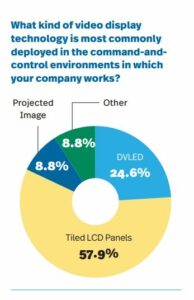

In Commercial Integrator’s exclusive research study, the most commonly deployed videowall technology in command-and-control environments is tiled LCD panels, accounting for 57.9%. DVLED follows with 24.6%, while both projection images and rear-projection cubes are used in 8.8% of cases each. Our thought-leaders all agree that thin-bezeled tiled LCD panels remain favored in most control-room applications for their cost-effectiveness but also to provide optimized visual acuity. Rear-projection technology retains significant value for specific use cases. Diversified’s Bonner adds that customers’ appetite for tiled LCD and cubes is still strong amid costly alternatives. “It’s true they don’t like the seams that either of those two technologies offer. However, they dislike the cost of 0.7mm DVLED even more, which is what is required to match, or get close to, the resolution of LCD and cubes,” he says.

Visual Sound’s Henze has a different take, saying, “In the past, LCD videowalls were often used because they were less expensive. However, we are now noticing that DVLED technology is becoming more affordable as costs decrease. As we continue to educate our clients about the distinctions between these technologies and witness more successful long-term installations, they are finding it easier to justify the additional cost of DVLED systems.” However, Diversified’s Bonner contends, “We’re still a few years away from the DVLED technology really becoming affordable for these hardcore control-room spaces.”

DVLED technology is the primary focus within TVS Pro’s designs. According to Parker, “DVLED stands out due to its superior visual performance, full video and power-redundancy options, and lower maintenance requirements.” He continues, “The modular nature of DVLED allows for easy servicing of individual pixel cards, ensuring high reliability and minimizing the impact of any outages. Unlike tiled LCD panels or projected images, where a failure can affect a larger portion of the display. DVLED systems can be repaired on a smaller scale with more serviceable components, reducing downtime and maintaining operational efficiency. This makes DVLED the preferred choice for mission-critical applications where uptime and clarity are paramount.”

Emerging AV Technologies

There’s a plethora of emerging AV technologies that are set to revolutionize command-and-control operations. AI and machine learning enhance real-time data analysis and decision support, while AR and VR can be used to improve situational awareness and training. Unified collaboration platforms like Microsoft Teams Rooms streamline communication across distributed locations. IoT integration and cloud-based solutions boost operational efficiency and scalability.

High-resolution videowalls and flexible display options, such as LCD and LED displays, are vital for detailed data visualization. The rise of microLED, chip-on-board LED and all-in-one LED technologies is set to significantly impact the market. As Visual Sound’s Henze says, “These advancements result in substantially diminished heat dissipation, thereby providing an optimal viewing experience, particularly with regards to long-term operator comfort. Anticipation surrounds the potential market impact and consequential influence on project cycles precipitated by these technologies. Notably, the prolonged lifespan of LED displays relative to LCDs is poised to significantly extend project cycles, consequently establishing service and support as a pivotal cost center.”

Diversified’s Bonner finds the technologies joining the AIMS Alliance of particular interest, as the organization aligns with making technology scalable. “Our goal is to create user experiences that are intutive and scalable. The manufacturers working together to allow for interoperability is a positive step forward for the control-room space,” he says.

Integrators ensure seamless AV integration in command centers through meticulous planning and collaboration with IT and communication teams. Courtesy / Solotech

Proactive Client Engagement is Key to Success

When we asked our thought-leaders about one thing that clients, organizations and operators could do that would empower their firms to be more successful/profitable when working in these environments, all of them echoed a similar sentiment: proactive client engagement is crucial. The sooner clients voice their concerns, needs and operational requirements, the better. Visual Sound’s Henze says, “Without their active involvement, we are simply providing equipment. Each project represents a unique design, custom to our clients’ specifications. We have observed other organizations failing to meet expectations once the project is completed and realizing that [our company’s] strengths are precisely what add value in the command-and-control market. We will be there for [the client] for as long as [they] need us.”

CTI’s Cameron advises clients that are new to the control-room-implementation process to involve a control-room integrator early on. “Integrators bring valuable expertise to the table, ensuring that projects are well-informed, streamlined and aligned with operational goals from the outset. This proactive approach not only saves time and money but also minimizes potential challenges down the road,” he says.

It’s not about technology decisions; it’s about good business decisions. As Diversified’s Bonner puts it, “I’ve seen too many customers regret their purchase and have to live with it because they didn’t understand the importance of partnering with a provider who not only had a great reputation, but also were financially strong and service oriented. We’ve picked up a lot of customers over the past 15 years who have been burned by the local AV integration shop in town. It’s an expensive mistake that can be avoided with the right guidance at the beginning. That’s why I am a part of the Command Control Alliance (C2A). The group’s mission is to help our customers/end users make better design decisions for critical operations.”

Command-and-Control Opportunities Await

While it is challenging working in the command-and-control market, it presents abundant opportunities for system integrators. These environments demand dependable AV systems crucial for decision-making and operational effectiveness. Integrators can leverage technologies like interactive displays and videowalls to craft tailored solutions, showcasing their innovation and expertise. However, they must navigate intricate technical specifications, high reliability standards and security concerns, including cyber threats and regulatory requirements. Balancing new innovations with legacy systems and budget constraints requires strategic planning. The evolution of distributed control rooms and AI-driven decision support systems enhances data visualization and decision-making, transforming control-room operations and promoting operational excellence.

Working in this market is not for the faint of heart. As Diversified’s Bonner explains, “This is a very niche space and has a high level of stress associated with it. Our technical staff must be ready for the challenges associated with this space, and it’s not easy finding people of the caliber we need to serve this unique community of clients. We are very deliberate in what we do so to make sure we do it at the highest level possible. We could grow faster by taking deals at lower margins and lesser complexity, but it’s not how we built this team. We want to be a great partner to our customers who want a long-term relationship.”

While AI’s full potential is still unfolding, opportunity is everywhere you look. Visual Sound Henze adds, “The amount of data that is available to a control room that wasn’t even considered 20 years ago is astounding. Data means there is somebody that wants to monitor it, impact it or otherwise apply it to something that helps their business. If something is connected to the internet in some way, it’s projecting data. We help our clients use it.”

For AVIXA’s Wargo, the key to success and profit, regardless of vertical, “…is both a focus on true value-added services like design and consulting as well as recurring-revenue options like managed services.” Both are easier said than done, though. As he explains, “Design requires strong capabilities and expertise in overall solution configuration, as well as early involvement in the sales cycle with the potential customer. Managed services require the appropriate people, tools and resources to support an ongoing relationship. Fortunately, AI is here to help that part, with improved remote monitoring and diagnostics capabilities. The economic environment and business needs both align to create increased demand for OpEx-based solutions, though, so the time is very ripe for a shift to managed services. If one integrator won’t, another one will. Better to be on the providing end of that equation for the long term.”

Opportunity awaits integrators who embrace the challenges of the command-and-control market and invest heavily in a service model designed to successfully support end users.

Download the full 2024 Command-and-Control Deep Dive Report here.