Editor’s Note: We published this annual State of the Industry story on Jan. 13, 2025. We updated the story as of Feb. 19, 2025.

Each year, Commercial Integrator + Security Sales & Integration teams up with our partners at NSCA to field an industry-wide survey whose goal is to assess the state of the integration industry. In the early days of a new year, in hopes of maximizing the integration community’s collective success, we present our eagerly anticipated State of the Industry analysis. Our goal is to arm integrators, consultants and other stakeholders in the channel with the information that they need to empower their leadership, optimize their operations and ensure ongoing profitability.

We not only present exclusive data from our survey but also feature insights and analysis from Tom LeBlanc, executive director of NSCA, and Sean Wargo, vice president, market intelligence, at AVIXA. Plus, we include a freshly written contribution from D-Tools’ data solutions architect and evangelist, Jason Knott. Leveraging data from D-Tools Cloud, he illuminates where product money is being spent in commercial AV and security.

Related: Don’t Miss the State of the Industry Webinar – January 14, 2025

State of the Industry: Business Climate and Integrator Optimism

The confluence of numerous factors (e.g., ongoing talent-related issues, uncertainty related to stiff tariffs, still-high interest rates) might cause the integration community to be in a cautious mood at the moment. Accordingly, during our survey field period (late fall and early winter 2024), although we found most integrators feeling relatively optimistic about their future prospects, sentiment was less rosy than it had been 12 months ago.

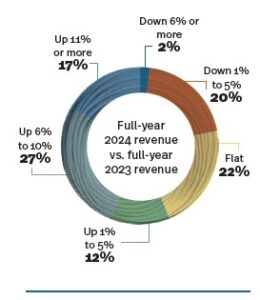

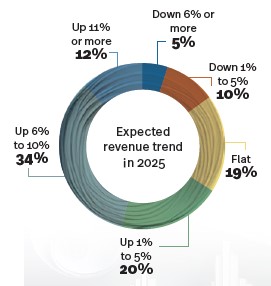

It’s true that 39% of respondents described the business climate as either “Excellent” or “Very Good,” as compared to 36% who said the same last year. However, 15% percent of survey takers said the current business climate is “Fair” or “Challenging,” a bit more than the 11% who indicated that last year. Looking to the year ahead, 66% indicated that they expect an upward revenue trend. That, on its face, looks very good; however, last year, 82% of respondents forecast an upward revenue trend, indicating more muted optimism this time.

Industry sentiment, of course, does not exist in a vacuum; it’s influenced by dominant media narratives, political messaging, geographic factors and more. Thus, it’s worth doing a “reality check” on the economy and its relative strength. For Wargo, the American economy tells a story of resilience despite ongoing pressures (e.g., high interest rates, inflation). To wit, core metrics of economic strength like GDP still look pretty good; for example, estimates indicate that the U.S. economy enjoyed a 3% annual rate of growth Q2/24 and a 2.8% annual rate of growth in Q3/24. “We’ve done better in a lot of quarters than we thought we would,” Wargo reflects. “And certainly no indicators, at least on that metric, of a recession so far.”

A Saddle Year?

Wargo does acknowledge a few specific indicators associated with recession risk — namely, declining workforce growth and slowing/weakening consumer spending — that have manifested in recent months. These perhaps factor into why he hypothesizes 2024 might prove to be a “saddle year,” marking a low ebb for growth, but with growth accelerating in 2025 and 2026. “We’re expecting better growth even than we saw in 2023 as we go into 2025 and 2026,” Wargo forecasts.

Data-driven positive predictions notwithstanding, NSCA clearly detects a level of unease among its members. “It seems like integrators are very concerned with macroeconomic issues this year as compared to past years,” LeBlanc says. This prompted NSCA to arrange for its economic analyst, Dr. Chris Kuehl, to send regular integration industry-specific economic reports. Like Wargo’s, Dr. Kuehl’s grounded take — free from the influence of panicky news in the media — doesn’t paint a picture that raises big concerns for 2025. This is especially true given the Federal Reserve’s posture to continue cutting interest rates, an economically stimulative action. LeBlanc points to the Fed’s 50-basis-point rate reduction last September as a move that will likely fuel investments. “That’s going to be good for our industry,” he reflects, “but it’s also going to take time [to be felt].”

State of the Industry: Industry-Specific Factors

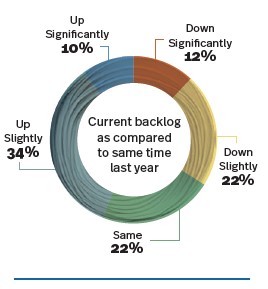

Let’s consider some factors more endemic to the integration industry, such as project backlogs and the cost of labor. Our industrywide survey suggests that backlogs aren’t quite as robust as in recent years, with 34% of respondents saying their current backlog is either “Down Slightly” or “Down Significantly” as compared to this time last year. Perhaps more tellingly, this year, 12% are in the “Down Significantly” column versus the 7% that characterized themselves that way in fall 2023. And only 10% of survey takers called their current backlog “Up Significantly” this time as compared to 25% who selected that description in fall 2023. What explains this apparent weakening of backlogged project work?

According to LeBlanc, there is less “smoke and mirrors” now (i.e., less backlogged work not ever coming to fruition or being indefinitely delayed); as we enter 2025, what you see is what you get. He harks back to 2023, when many NSCA member integrators had backlog of 50% or more of their annual revenue, and says, “Those numbers were probably a little inflated.” He continues, “Now, it’s trending closer to 30% to 40% of their annual revenue.” But this reflects reversion to the mean rather than any genuine weakness.

Wargo agrees, acknowledging that the last few years added a lot of distortion to our market with supply-chain lags, held-up projects and artificially large backlogs. By the end of 2023, he says, much of that had cleared out. Nevertheless, in the months since, integrators have still been booking projects and enjoying growth.

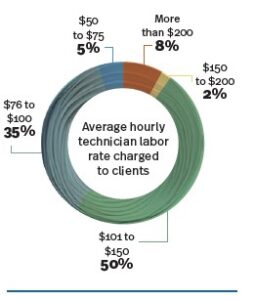

The Cost of Labor

One thing that seems not to have normalized is the cost of labor, a problem driven not only by global inflation in recent years but also by a scarcity of available technical talent. “You see that in economic data and in our own surveys,” Wargo confirms. “Year over year, a pretty healthy increase in the cost of your labor.” Thus, it’s perhaps not surprising that, in our survey, 50% of respondents said they’re charging clients between $101 and $150 as their average hourly technician labor rate. Another 8% pegged the average hourly rate as $200 or more. What may be surprising is that those percentages were comparable in last year’s survey: 48% for $101 to $150 and 7% for $200 or more.

If Wargo is right about a continuing escalation in labor costs, the integrator community might need to be more aggressive in passing along those costs in the form of higher hourly rates. As he puts it, “You are providing value even more than you ever were because we have become much more mission critical in what we deliver as an industry. We’ve become more intrinsic to the experience. So, charge accordingly.”

LeBlanc, too, regularly makes this point, emphasizing the mission criticality of professional integrators. Integrators’ customers, he says, lean on them to evolve their technology solutions and give them the necessary tools to attract and engage their audience. “They can’t afford for it to be down,” LeBlanc declares, offering an astute generalization for markets ranging from corporate to government to education to retail. Thus, he underscores that it’s not a winning strategy to compete on lowest price; rather, savvy integrators are differentiating via quality of service, design work and customer service.

State of the Industry: Opportune Markets

LeBlanc, when asked about opportune markets for integrators, pointed to data from NSCA’s Electronic Systems Outlook, a twice-annual report that looks at construction trends as a proxy for work that is to come. Overall, the ESO shows modest slowing in construction activity but with some markets growing healthily. Positive standouts include education (higher ed and K-12), up 7%; government, up 18%; house of worship, up 7%; and manufacturing, up 21% — the last largely fueled by reshoring efforts. Negative standouts include retail (down 7%) and lodging (down 6%), with corporate construction spending kind of flat. This construction data, while invaluable, may not perfectly correlate to planned or actualized technology spending.

Wargo, meanwhile, explains that, in recent years, corporate and education AV have become much more commoditized, making those markets more about volume than about value. We all know how strong those markets were during the pandemic due to the need for immediate adaptive expenditure, and integrators pivoted their businesses to make the most of an insatiable appetite for UC&C solutions. But there’s a corollary. “The market has adapted, too,” Wargo says, “by providing affordable, scalable, reliable technologies that can be deployed in a much easier, simpler fashion by IT departments that don’t have to know as much about AV.” Thus, if an integration company is looking to sell value, corporate and education might not be the markets to emphasize — unless, that is, your integration business can leverage demand for non-traditional enterprise broadcast in the form of enhanced corporate communications and streaming media.

Wargo argues that large venues, hospitality, transportation and retail are markets in which integrators naturally contribute more value-add. “Where there’s an experiential component,” he states. “That is where we are seeing a lot more growth and, I would expect, a lot more opportunity for revenue and profit.” This aligns with the resurgent experience economy and people’s desire to be “wowed” by attractions like The Sphere and immersive communal spaces like Cosm, which traffics in something known as “Shared Reality.”

Solution Areas

AVIXA’s most recent data indicates that the total commercial AV market is expected to enjoy a 5.35% compound annual growth rate (CAGR) over the next five years. This provides a useful benchmark in considering different solution areas for integrators to emphasize or deemphasize in the months ahead. One outperformer that Wargo emphasizes is digital signage. Indeed, he says, “If you’re an AV integration firm not strongly looking at digital signage today, you’re behind.” With displays becoming so cheap — we have seen deflationary pricing in the display category, in fact — we are seeing more installations, more opportunities for touchpoints and, most importantly, more opportunities for integrators to sell services. That means abundant opportunity to add value in the form of creative installation, two-way interactivity, data analytics, content-management services and content-as-a-service. “There’s a lot of value to be provided in a digital signage environment,” he concludes.

Related: Digital Signage: A Complete Guide

Wargo also reemphasizes enterprise broadcast as a key opportunity. “How are you helping your customer stand up simple production capabilities [and] streaming services to reach and engage your customers, your employees [and] your audiences?” he asks rhetorically.

Finally, Wargo returns to the adaptive expenditure that fueled considerable success in the corporate and education verticals in past years and offers a word of caution. “Conferencing and collaboration [are] growing at a much slower rate than performance/entertainment or live events,” he says. Yes, there’s revenue to be earned from soft-codec huddle spaces in enterprise locations, but the margins will likely be tighter now. “You have to be getting beyond your comfort traditional zones in order to grow at a better-than-market rate,” Wargo states. That means going all in on recurring revenue, remote monitoring, data analytics and upgrade pathing.

State of the Industry: Recurring Revenue

On the topic of recurring revenue, our industry survey offers glimmers of optimism after numerous years in which percentages of integrators seizing on the RMR opportunity stayed stubbornly low. To wit, a combined 35% of integrator respondents said 21% or more of their revenue is now services-driven or subscriptionized. (As a point of comparison, only 9% answered a similarly worded question that way in fall 2023.)

This trend also manifests when we asked integrator respondents to forecast the percentage of revenue they expect to generate from services in the coming year. This time, 22% of survey takers chose the lowest option (“Less than 5%”); in fall 2023, a slightly higher number (23%) selected it. More tellingly, 41% of this year’s respondents said they expect 21% or more of this year’s revenue to derive from services, whereas, last year, only 16% forecasted similarly.

LeBlanc chalks up developments like this to a mindset shift, perhaps driven by the combination of more standardized rooms and a greater recognition of the integration industry’s criticality. Critical systems must stay online and be fully reliable, and that means clients may be more willing to either subscriptionize their technology estate or, at the very least, invest in remote monitoring and maintenance agreements.

NSCA’s Financial Analysis of the Industry, released last year, offers an independent assessment of the revenue percentages that integrators attribute to recurring sales. According to LeBlanc, “That shows an average of 14.2% of revenue stemming from recurring sales. Maintenance agreements and managed services are the biggest drivers of that.” Larger integration companies do slightly more than that average (17%), while the smallest companies do very little (2%, on average). “Clearly, the smaller companies are struggling more than the larger companies,” LeBlanc concedes. “But it’s an important struggle,” he emphasizes.

Getting Up to Speed

Integrators that want to get up to speed on selling services and transitioning to an RMR-minded business model should recognize a couple of facts: First, there’s no simple explanation or “one weird trick” for how recurring revenue is successfully adopted within integration businesses. Second, integrators climbing this mountain don’t need to go it alone — options exist to smooth the path.

“The smaller companies, in particular, should be looking for areas where they need support in order to be able to provide what many of their customers might be demanding,” LeBlanc says, referring to clients’ growing desire for reassurance of continuous upkeep and uptime of their systems. “If smaller companies need help,” he adds, “they should seek it in the areas where they need it.” That might mean working with NSCA Member Advisory Council member Revenueify to make the transition to more of a recurring revenue model. Integrators can also consider working with NSCA Business Accelerator GreatAmerica to offer more efficient financing.

TAMCO is another partner option to help integrators subscriptionize technology design and integration.

Meanwhile, Wargo points to distributors as a potential hand up, saying that the pandemic pushed many integration firms to work with distributors as part of their supply-chain risk-mitigation strategy. “Distributors are also a great place to go to look for best practices and toolkits and solutions around this kind of offering,” he states. Wargo elaborates further, saying, “They know what’s available out there. They have the training staff to help you get up to speed. They can help you do it contractually.”

State of the Industry: Talent-Related Challenges Persist

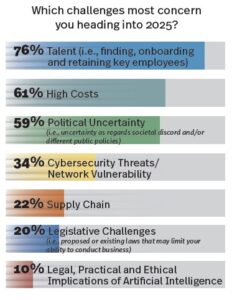

We’ve already alluded to a scarcity of technical talent and the broader talent-acquisition and talent-retention issues that integrators face. We’ll now turn to those, given that, according to our survey, talent is by far the biggest concern that respondent integrators have heading into the new year. Indeed, 76% of survey takers chose “Talent” as one of their top three challenges, with the second-ranking choice (“High Costs”) only registering 61%. (Given that we fielded the survey during the height of election season, it’s no surprise that “Political Uncertainty” registered in third place, garnering 59%.) Other prospective concerns — “Cybersecurity Threats/Network Vulnerability” (34%), “Supply Chain” (22%), “Legislative Challenges” (20%) and “Legal, Practical and Ethical Implications of Artificial Intelligence” (10%) — are further down the list in respondent integrators’ minds.

Diving deeper into the problem, we see that “Lack of Qualified Candidates” was the prime reason that survey-taking integrators gave (garnering 54% response) when asked about their biggest challenge in filling open positions. Arguably, part of the blame lies in the absence of a clear pathway into the integration industry. Unfortunately, many high school, college and vocational school graduates have no idea of the lucrative and satisfying career opportunities that our industry could offer them. Finance-related impediments are also inhibitors, with 24% choosing “Candidates’ Salary Demands are Escalating” as their biggest challenge; meanwhile, 12% lamented “Insufficient Budget to Hire New Employees.” The final option, “No Time to Find/Recruit Candidates,” barely registered at 5%.

Related: Cultivating Diverse and Youthful Talent for a Thriving Future

Perhaps most troublingly, our survey data indicates that a lack of qualified candidates is a widespread problem across disparate roles. Indeed, although “Installer/Technician” attracted the most response (32%) when we asked survey takers which type of role is hardest to fill, both “Sales” and “System Design/Engineering” garnered a substantial 15% response. Right behind those was “Programming” (13%), followed by “Project Management” (5%). Remarkably, 15% of respondents chose “All of the Above,” meaning those integration businesses find every one of those roles hard to fill.

State of the Industry: Downside Risks

There seems to be little doubt that talent-related issues, if they aren’t mindfully remediated, represent ongoing downside risk to the integration industry. However, according to our industry analysts, although the overall picture remains pretty bullish for integrators, additional downside risks are worth weighing.

“The biggest risk and opportunity for integration companies as they enter 2025 is making sure they don’t fall behind,” LeBlanc reflects. Today’s customers are interested in using technology to create more dynamic, more engaging, more productive, more inspiring environments. Moreover, they’re interested in AI and solutions that live on the network. LeBlanc notes that many integrators are struggling with the rapid pace of evolving technologies and customer demand. If the integration industry is going to seize on key growth areas (e.g., IP endpoint devices, IoT, AI, machine learning, robotics), we must collectively level-up our skill set.

This year’s survey data paints an equivocal picture of integrators’ level of training and readiness to tackle IT-centric installations. Only 35% of survey respondents said they were “Completely Ready” for this kind of work, along with 45% who said they were “Still Working On It.” More than one-in-10 survey takers (13%) described themselves as “Not Sufficiently Trained.” Perhaps more troublingly, 7% said the question was “Not Applicable” to them. With the lines between technical trades, as well as IT and networking, blurring more every day, it’s worth pausing to consider why any integrator would think they’re immune to these trends.

As LeBlanc astutely observes, “Integrators are well positioned to be right there in the middle of an explosion of growth in IT and IoT devices. So, they need to make sure that their teams are trained and ready for what their customers need now, and what they’re going to need in the future.”

Meanwhile, Wargo points to economic factors as continuing to present possible downside risk for integration businesses. As discussed earlier, AVIXA data shows a resurgent experience economy in which integrators can provide real value; however, such an economy is highly consumer-dependent. “We have to have a consumer who’s out there who wants to experience things…who’s spending on that,” he says. Any signs of retrenchment would likely mean a slowdown in venues and events again. It’s something that, for integrators, is worth watching closely, especially if they’re looking to dive into “Shared Reality” and other emerging approaches.

State of the Industry: Key Opportunities

Although downside risks are real, so, too, are ripe opportunities for integration businesses. “Integrators are extremely important right now, and that’s the opportunity,” LeBlanc declares. “To take advantage of that opportunity, integrators really need to position themselves to be what their customers need them to be.” That means seizing on IoT as a hot technology trend in the connected technologies and smart building sector. “The opportunities for growth and profitability for integrators directly correlate to them being trained and ready to be the IT-centric partner that [clients] need them to be in order for them to reimagine their solutions,” LeBlanc explains.

Wargo, for his part, makes the case that adjacencies are plentiful for integration businesses to explore. In short, then, 2025 might be the year for integrators to widen their apertures and explore emerging, more non-traditional ways to deliver outstanding outcomes for clients. “Broadcast AV is well poised to weather a contraction in consumer spending because it’s all about reaching your customer, wherever they are,” he says, harking back once again to abundant opportunity related to enhancing corporate communications and streaming media for enterprise broadcast.

Wargo also underlines clients’ near-boundless appetite for data and analytics for large-scale projects and small-scale projects alike. “Businesses want their systems [and] their experiences to be generating data that also helps them understand their customer needs better,” he explains. Digital signage is just one technology tool that commercial environment operators can leverage to capture data about the customer. For example: How is the customer navigating the store? What are they looking for? “How do we use the in-person experience as a collector, aggregator and real-time analytic engine for [the customer’s] business?” Wargo asks rhetorically. Integrators who solve that riddle will have a leg up on the competition.

State of the Industry: Business Owners’ Greatest Imperative

Amid all these new, emerging opportunities for integrators to achieve strong profitability, perhaps business owners’ greatest imperative in 2025 — apart from having an intentional plan to deal with ongoing talent-related challenges — is to strike a careful balance between leaning forward and readying the team to provide the solutions customers are imagining for the future and preserving the existing efficiencies of the company. “It all adds up to an escalating need for almost continuous training,” LeBlanc says. At the same time, integrators cannot be cavalier about taking their most productive people “out of rotation” continually.

Don’t forget to tune into our 2025 State of the Industry webinar on Tuesday, Jan. 14 at 12 pm EST. Register here!

If you have feedback about this State of the Industry report, please share your thoughts with me at [email protected].