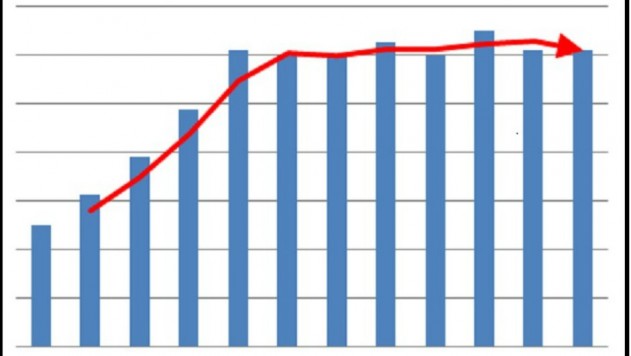

AVIXA’s monthly Pro AV Business Index, the gauge of the health of the AV industry, ended 2017 relatively flat in both sales and employment, with many survey respondents saying the traditional holiday season slowdown kept them from seeing substantial growth.

In the monthly report, the Pro-AV Sales Index continue its slide, this time from 59.6 in November to 58.3 in December, while the Pro-AV Employment Index dipped from 58.6 to 57.8 from November to December.

The survey has a margin of error of 1 point, meaning the employment index is within that margin and the sales index is just slightly above it from month to month, says AVIXA senior director of market intelligence Sean Wargo.

“We’re seeing a consistent story of growth,” he says. “Staying up around 60 is a very positive story.”

The Pro-AV Business Index measures the health of the AV industry, based on how many firms either stayed the same or grew at least 5 percent. Any number above 50 is an indication of a healthy market.

“The numbers are still healthy,” says James Chu, director of market intelligence for AVIXA, noting both employment and sales indexes are similar to the figures from December 2016 (61.0 in sales and 57.3 in employment).[related]

Wargo wonders whether survey respondents had fully absorbed the effect of the tax reform package approved by the Trump administration when responding to the December poll and what effect those changes will have on the panel and the industry.

“We’ll see where this goes,” says Wargo. “For now, it’s a bit of an unknown.”

The plans for a new Apple headquarters could also play a role in helping to boost the index going forward, says Chu, but the brief federal government shutdown is unlikely to affect anything, says Wargo, because it was less than a week in duration.

Chu notes the Architectural Billings Index, the industry health gauge in the architecture industry upon which the Pro-AV Business Index was built, saw a 55 figure for November, higher than in recent months and a possible harbinger for the AV industry.

Wargo wonders if that spike will eventually show up in AVIXA’s index and is curious to see where the Pro-AV Business Index falls in the chain as a lead or lag indicator of health.