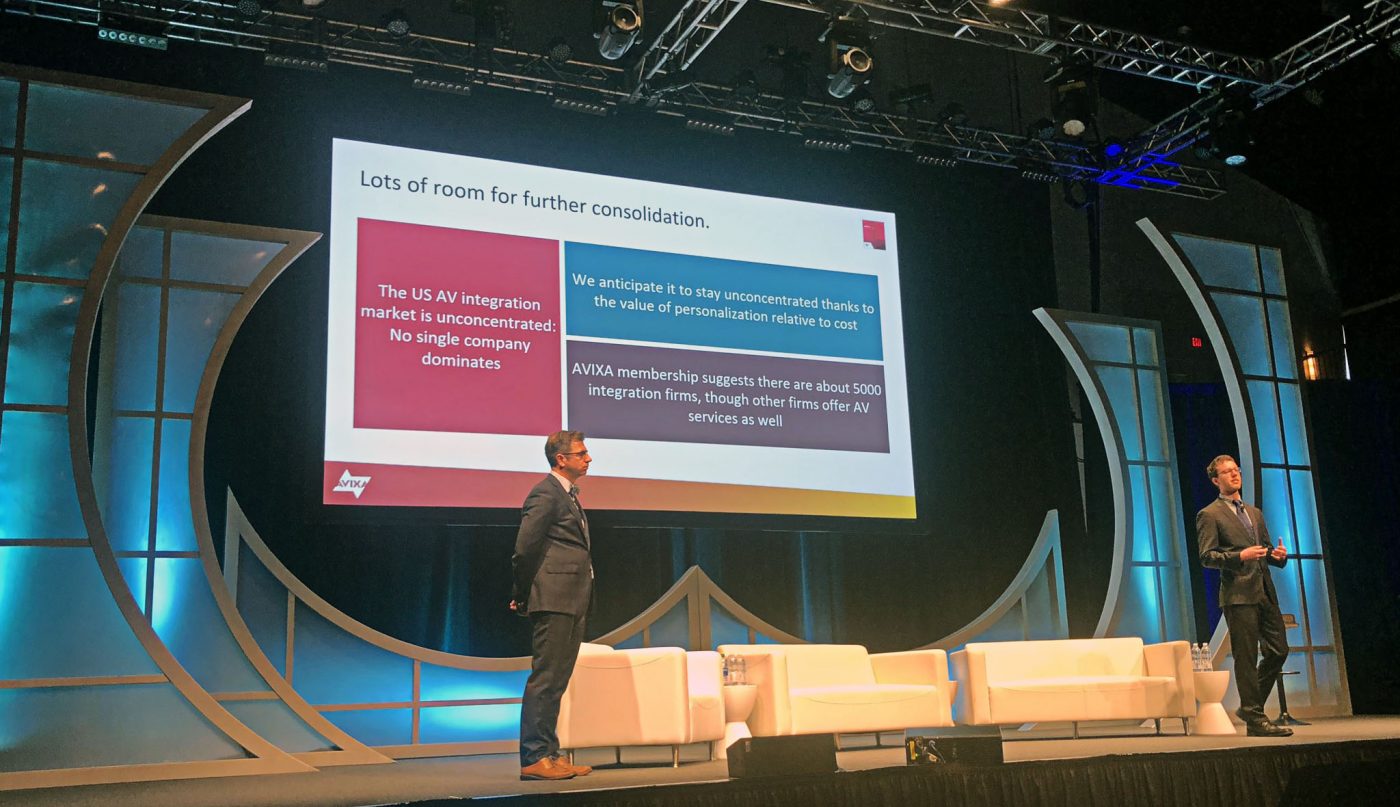

In November at the AVIXA AV Executive Conference, the trade association’s economists spoke about market saturation — or the lack thereof — in the professional AV industry.

No one company dominates the space, said AVIXA economists Peter Hansen and Sean Wargo at AVEC.

With last week’s news that AVI-SPL and Whitlock — two industry titans — plan to finalize a merger by the end of next month, have those thoughts changed?

Based on AVIXA’s market research, this merger doesn’t actually change much and the space is still wide open for companies of all sizes to make an impact, Hansen said in an email.

“End users report that they value customization and customer service, two capabilities where small companies can compete with large companies,” Hansen wrote. “End users also report that while they sometimes turn down integrators for being too small for their needs, they also sometimes turn down integrators for being too big.”

According to Hansen, the AVI-SPL/Whitlock mega-deal could actually improve competition and give small AV businesses a leg up, allowing them to be more nimble and adaptive to rapid changes in the industry.

Read Next: AVI-SPL and Whitlock Mega-Merger Surprised Both Companies’ Execs Too

This echoes the organization’s Macro-Economic Trends Analysis from September 2019, which said despite some robust M&A activity and consolidation, the U.S. integration market is far from being dominated by one or several companies.

Hundreds of businesses of all different sizes are still operating successfully, and much of the industry is still family-owned and mom-and-pop in nature. However, the industry appears to be trending in the opposite direction, and has been for a few years.

In addition to AVI-SPL and Whitlock, Diversified made a splash in the M&A headlines last week, acquiring Sensory Technologies in a deal that gives the combined firm more than $1 billion in annual revenue.

In less than two days, the pro AV added two $1 billion integrators. If this market consolidation continues at this current pace, the industry may not be as hospitable to small-market firms unless they carve out a niche and differentiate themselves to stay competitive.

A shrinking industry

According to Tom LeBlanc, the former Commercial Integrator editorial director and now NSCA’s director of industry outreach and media channels, the merger and acquisition activity in pro AV is shrinking the industry and the gap between small AV businesses and industry titans is growing. Still, the end user’s demand for the technology continues to increase.

“There are fewer companies, but on the flipside, there’s more demand for AV integration than there has ever been,” he says, suggesting there is still room for smaller integrators and startups to join the industry.

While having massive competitors that can be more than 10 times as large is definitely a challenge, smaller companies can focus on their strengths and what they can do better than any other company, regardless of size.

Of course, these big companies can be intimidating. They’re likely able to undercut smaller integrators on price and will probably me more versatile and have a footprint that spans almost the entire country.

“Now is the time to take a look at what your sales and marketing messages are,” says LeBlanc. “Now is the time to really identify what it is you do well and make sure it’s coming through in interactions with your customers.”

How can smaller integrators stay relevant in an industry increasingly dominated by a handful of companies?

Relationships will be key

Scott Wright, president and co-owner of Wisconsin-based small-market integrator Lifeline Audio Video Technologies, says his business will continue to focus on building relationships with its customers.

The firm is based in a rural part of southern Wisconsin, and relationships have always been an important part of the business.

You must remain competitively priced, but price is only a small portion of why decision-makers buy for a design-build job, Wright says.

Lifeline Audio Video Technologies counts the house of worship market among its largest in rural Wisconsin.

For larger integrators that have more room for advancement and promotions, building and maintaining a consistent relationship with a customer through familiar faces can be challenging. This gives smaller integrators the advantage, Wright says.

“You have people advance more in a company and get moved to different territories, which means there is no consistency with a person building a direct relationship with the customer,” he says.

“The company may still have a relationship with the customer but not an individual which is completely different.”

Smaller projects

Not every audiovisual project is huge and demands the power of a company like AVI-SPL, Whitlock, Diversified or other big-name integrators.

The behemoth company that will soon emerge will have a giant budget and will be after large projects, leaving the small high-margin projects to firms like Lifeline.

Wright referenced a small church in which Lifeline installed a sound system 18 years ago. With small upgrades and regular maintenance no longer cutting it, the church is ready for a full upgrade to the front end of their system. It’s a relatively small project of about $20,000.

But for Lifeline, this is their bread and butter.

“This is a nice project for us,” says Wright. “It’s small in terms of financial dollars but it can have a very high gross profit margin.”

Wright opined that the new AVI-SPL probably wouldn’t even be interested in a project like that.

“They are not going to send someone out and get involved in $20,000 sound systems in the middle of Iowa,” Wright says, adding that it probably wouldn’t even be profitable for a company of that size. “It will be profitable, however, for my firm.”

Service and speed

Rick Ford, owner of AV Integrators in the small central Massachusetts suburb of Rutland, says the firm can be more nimble than larger competitors and turn projects around much faster.

Ford says his company — which numbers four total employees — specializes in Zoom Rooms in a cost-effective way whereas larger companies are always trying to maximize profit.

“We can come in and get the same results with most cost-effective solutions,” Ford says.

AV Integrators is also able to offer better service plans, especially after a larger integrator does the initial work but doesn’t offer any follow-up services or maintain relationships with the customer. That lets smaller companies like Ford’s to move in and pick up those clients.

“Large companies are like the Titanic trying to turn their rudder all of the time to get into place,” he says. “We can swim around them.”