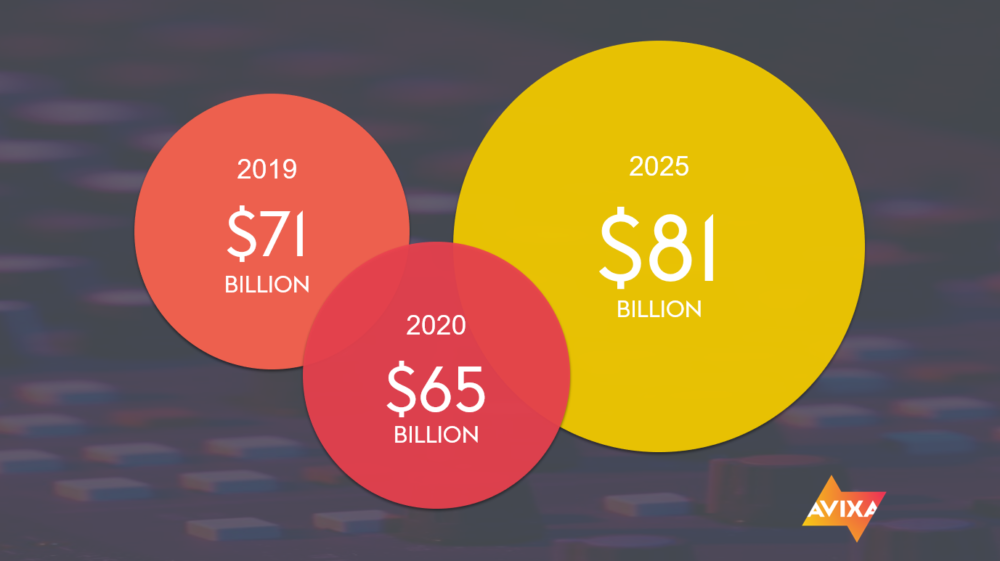

Following a rise to $71 billion in 2019, the Europe, Middle East and Africa (EMEA) pro AV market is set to fall by 9% in 2020 to $65 billion as COVID-19 impacts regional economies, according to the new 2020 AV Industry Outlook and Trends Analysis (IOTA) EMEA Summary produced by AVIXA.

The region will “mount an extended recovery starting in 2021,” according to AVIXA’s research, with revenue set to return to its 2019 level in 2022, hitting $71.5 billion and $81 billion in 2025.

Those projections mirror fairly closely the global trends that show the seeds of recovery starting in 2021 and a return to profitability in 2022.

“The pro AV industry and economies at large are reeling from the effects of COVID-19,” said AVIXA senior director of market intelligence Sean Wargo in the association announcement. “The pandemic has broadly impacted the near-term and longer-term outlooks for economic growth and business activity in the EMEA region, spurring reductions in our forecast.

“But recovery is in sight. Growth for pro AV in EMEA will far exceed the expansion of the regional economy, with the industry growing in the range of 5.1% to 4.8% in the coming years,” he said.

Inside the IOTA EMEA pro AV market summary

Western Europe leads pro AV revenue for EMEA, with 39% of the regional revenue—a share that will largely hold steady through 2025. Western Europe is forecast to hit $25.3 billion in 2020 and reach $30.6 in 2025.

The Sub-Saharan Africa market will generate the strongest growth in the region, with a 6% CAGR from 2020-2025, growing from $1.7 billion to $2.2 billion. The Central European pro AV market is set to expand to $12.5 billion in 2025, rising at a CAGR of 5.8% from $9.4 billion in 2020.

In EMEA, the media and entertainment market stands out among the pro AV industries for its relatively strong performance during the COVID-19 crisis, with revenue declining by only 5.6% in 2020 and rising by 8.5% in 2021.

The consumption of digital content from mobile apps to TV and gaming has sharply increased during the pandemic. This gives rise to production, storage, and distribution equipment, software, and services.

The military and defense industry is expected to invest heavily in pro AV technology in the mid-to-long-term, driving growth from $3.6 billion in 2020 to $4.4 billion in 2025.

Related: Why AVIXA Pro-AV Business Index is Encouraging Sign

Government and military, education, and corporate will generate the most demand for security, surveillance, and life safety solutions during the short and long terms as they seek to update their infrastructure to handle the needs of monitoring and responding to the pandemic.

Digital signage growth will be driven by an increased need for on-premise and out-of-home (OOH) communications, especially for security and new health protocols. The functionalities of digital signage merge with those of surveillance and security.

This is applicable to both employee-facing and customer-facing situations. For example, surveillance cameras already in place will be augmented by AI, software, and displays and used for business analytics for assessing customer journey, tracking, and heat-mapping.

Looking at the ranking of pro AV solutions in EMEA from 2020 to 2025, conferencing and collaboration leads the region thanks to the prevalence of work from home. Revenue will increase at a CAGR of 2.6% during this time.

Spending will continue to increase in this area as legacy infrastructure gives way to the cloud. Cloud traits such as flexibility, scalability, ease of use, and cost effectiveness will help drive collaboration in the short- and long-terms.