The last 22 months have been trying not only for the commercial AV industry and those who work within it but also, more broadly, for society at large. We’ve confronted a global pandemic like nothing seen since the early 1900s.

We’ve faced a calamitous economic contraction that resulted in tens of millions of jobs lost. Our government invested heavily in helping us to recover, but, arguably, that spending has contributed to the worst inflation in decades. And global supply chains have been snarled for months, resulting in sometimes-interminable waits for product to arrive.

And yet, when Commercial Integrator, in Q4/21, surveyed the commercial AV community and asked detailed questions about revenues, the project pipeline and other metrics, we found substantial optimism. Indeed, not only are things looking far better than they did last year but also, importantly, integrators are bullish about 2022. It’s time to say that the bounce back has begun.

“What we sell—what our industry does—is in very high demand,” Chuck Wilson, CEO of NSCA, observes. “I use the term ‘mission critical.’” He adds that we’ve only just scratched the surface of our indispensability for commercial buildings, a fact that will redound to integrators’ benefit in the years to come.

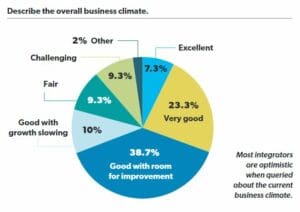

This aligns with Commercial Integrator’s survey data. When asked about the overall business climate, 30.6% were unequivocally positive in their assessment, and another 48.7% were positive but with some reservations. Only 18.6% attested to a fair or challenging business climate. This marks a meaningful improvement from last year, when 27.1% described the climate as fair or challenging.

Strong Revenues

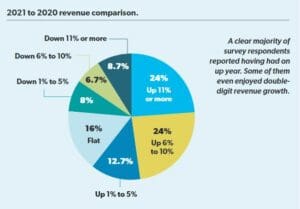

To assess market strength, we must evaluate revenue, and Commercial Integrator’s survey asked not only about 2021 projections but also about anticipated revenue for the new year. When we asked how 2021 revenues have compared to those from 2020, 60.7% of respondents reported having an up year; indeed, two-fifths among that number reported being up 11% or more.

By comparison, last time, only 28.8% of survey takers reported having an up year. The difference is even starker when we look at those reporting having suffered a year-over-year revenue decrease. This time, only 23.4% of respondents indicated that they had a down year. That’s as compared to last time, when 59.3% were down (and, of those, nearly seven in 10 had been down more than 5%).

Thus, the revenue trajectory seems robust, setting us on an auspicious course for the new year. David Labuskes, CTS, CAE, RCDD, CEO of AVIXA, says, “[The AV Industry Outlook and Trends Analysis] currently forecasts strong growth for pro AV revenues in 2022, rising a further 11.1% globally after increasing 8.5% in 2021. Total revenues are expected to reach $258 billion next year, on our way to full recovery across all regions by the following year.” And Shawn Hansson, CEO and founder of Logic Integration, Commercial Integrator’s just-named Integrator of the Year, underscores the strength of his firm’s project pipeline, saying there’s between $5 and $6 million in there right now, with a close rate of 50% or 60%. He explains, “Usually, the fourth quarter and then Q1 of the upcoming year are a little lower, but it’s actually looking pretty decent.”

Thus, the revenue trajectory seems robust, setting us on an auspicious course for the new year. David Labuskes, CTS, CAE, RCDD, CEO of AVIXA, says, “[The AV Industry Outlook and Trends Analysis] currently forecasts strong growth for pro AV revenues in 2022, rising a further 11.1% globally after increasing 8.5% in 2021. Total revenues are expected to reach $258 billion next year, on our way to full recovery across all regions by the following year.” And Shawn Hansson, CEO and founder of Logic Integration, Commercial Integrator’s just-named Integrator of the Year, underscores the strength of his firm’s project pipeline, saying there’s between $5 and $6 million in there right now, with a close rate of 50% or 60%. He explains, “Usually, the fourth quarter and then Q1 of the upcoming year are a little lower, but it’s actually looking pretty decent.”

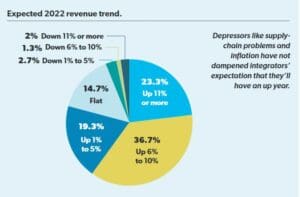

Returning to our survey data, let’s turn to how integrators expect revenues to trend in the new year. About 79% of survey takers expect 2022 to be an up year for them, with nearly three in 10 among those anticipating revenue growth of 11% or more.

Returning to our survey data, let’s turn to how integrators expect revenues to trend in the new year. About 79% of survey takers expect 2022 to be an up year for them, with nearly three in 10 among those anticipating revenue growth of 11% or more.

The most recent survey found integrators substantially more bullish than in Q4/20, despite the fact that, climbing from the depths of the pandemic year, firms might naturally have been expecting year-over-year growth. Looking back to that time, however, only 69.5% of respondents articulated an expectation for revenue growth. Returning to this year’s numbers, a mere 6% are forecasting a down year; that compares to 11.9% of survey takers last time who forecast a revenue decline.

Tom LeBlanc, executive director of NSCA, amplifies the optimism, saying, “There are a lot of opportunities. The pipelines are seemingly healthy. What integrators provide has never been more mission critical, in part related to demands that emerged during the pandemic. It’s a great time to be an integrator.” However, he hastened to add, it’s a challenging time to be an integration company leader.

There are numerous challenges (e.g., the supply chain, talent recruitment and retention, the shift to services) that require agile company leadership, and the commercial AV industry’s collective welfare depends on those leaders’ success.

Hansson, speaking as a company leader, emphasizes Logic Integration’s investments in getting its team CTS certified, for example, as well as fostering a positive company culture. He adds, “For next year, we are planning on more of a flat budget, but we are also going to be increasing our margins, setting up incentives and focusing on being a more efficient team.”

Related: State of the AV Industry 2021: The Year Integrators are Needed More Than Ever

Fewer Projects, Greater Complexity

One superficially discordant datapoint lies in our question about how many commercial projects respondent companies had completed over the past 12 months. A surprisingly large proportion of survey takers (41.9%) indicated that their firm had completed 25 or fewer commercial projects during 2021. (As a point of comparison, only 30.6% of respondents indicated that in the previous survey.)

By contrast, just 29.7% of survey takers reported having completed more than 100 projects during 2021. For that metric, the prior survey’s comparison point was 39% of respondents. Therefore, it appears that integrators are completing somewhat fewer commercial projects, but they’re nevertheless optimistic and projecting an up year ahead. So, what gives?

NSCA’s Wilson chalks it up to integrators focusing on the kinds of projects that call for the expertise and knowledge they’re selling. He explains, “We have to be willing to say, ‘We’re going to focus on our sweet spot,’ which, in many cases for the NSCA member, is the larger and more complex project.” This aligns with Wilson’s mantra that integrators should sell value, and that value often comes with an appropriately sizeable price tag. He continues, “Let’s do fewer jobs, but let’s do the bigger jobs that we scale better to. And let’s do it in a way that we know how to make money doing these things.”

Deciding which projects to take on might become an increasingly important challenge. AVIXA’s Labuskes indicates that the association’s research paints a rosy picture of demand for integrators in the months ahead.

He remarks, “AVIXA’s market research doesn’t track project numbers, but our Market Opportunity Analysis Report [MOAR] does show a steady increase in the percentage of end users who are planning capital improvements across the quarters of 2021.”

Many of those capital-improvement plans should soon blossom, resulting in integrators having to decide which projects suit their talents.

Incredible Vanishing Margins

Both NSCA and Commercial Integrator spend a great deal of time offering resources to help integrators run their businesses better. Perhaps no single consideration is more critical than ensuring every single project is profitable and contributes to positive cashflow.

In that regard, ever-shrinking hardware margins can pose a real threat. According to NSCA, making roughly 30% margin on hardware is about right, given that most integrators have overhead-cost percentages in the high 20s. Somewhat alarmingly, though, our survey data shows many integrators are struggling to hit that mark. Indeed, 24.2% of respondents reported that they make 10% or less in hardware margins. Another 28.9% indicated that they make 11% to 20% in margin. If NSCA’s figures are correct, that would imply a sizeable number of integrators aren’t covering their overhead when they’re moving product.

NSCA’s Wilson laments, “If they [pass through hardware] and then wait for their money to be collected [by selling labor or something else], they’re really going to suffer from a financial perspective.” He also said that moving hardware at such low prices cuts against the previously mentioned idea of recognizing ourselves as mission-critical providers. “You don’t have to race to the bottom,” Wilson emphasizes. “You have to sell value. And with those kinds of numbers, it’s selling price—not value.”

NSCA’s Wilson laments, “If they [pass through hardware] and then wait for their money to be collected [by selling labor or something else], they’re really going to suffer from a financial perspective.” He also said that moving hardware at such low prices cuts against the previously mentioned idea of recognizing ourselves as mission-critical providers. “You don’t have to race to the bottom,” Wilson emphasizes. “You have to sell value. And with those kinds of numbers, it’s selling price—not value.”

Selling Services

Many in the commercial AV industry are probably tired of hearing the pitch for moving to a services-based business model. However, although we’re seeing improvements, our survey data indicates that we still have a long way to go.

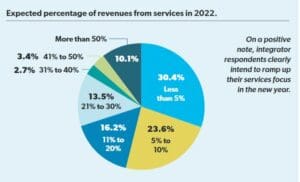

Some 65.1% of respondents said that, right now, they make 10% or less of their revenue from service contracts. Another 22.8% of survey takers indicated that they make between 11% and 30% of their revenues from services. It’s worth spotlighting the 7.4% of integrator respondents who affirmed that they make more than 50% of their revenues from services. Arguably, they’re forging a path to a more sustainable, profitable future.

AVIXA’s Labuskes digs into the association’s own numbers and finds even more reason for integrators to pivot to services. He says, “Our current managed-service forecasts predicts 8.4% [compound annual growth rate] from 2021 to 2026, which is faster than the overall industry growth rate of 7.2%. This wouldn’t appear to be blossoming as yet, but we view this as a key upside area given that AV makes up about 25% of OpEx budgets.” Labuskes also mentions IT’s frequent involvement in the AV decision-making process, saying that IT professionals are more accustomed to as-a-service purchasing.

Looking at survey takers’ forecasts for the new year, they clearly expect to ramp up the percentage of their business centered on services. Some 54% of respondents expect services to be 10% or less of their revenue. That’s 11 percentage points fewer than at present, meaning that an appreciable number of firms will aggressively ramp up this year.

Indeed, whereas, at present, only 23.5% of integrators report that their services revenue composes 21% or more of their annual dollars, the same survey finds 29.7% of integrators expect to reach those heights this year. Thus, it’s not so much about persuasion anymore as it is about execution.

Logic Integration, is moving steadily in that direction. “We put together some really healthy goals, and we’ve actually hit all those goals this year,” Hansson enthuses. “We plan on doubling our services and recurring monthly revenue [RMR] next year. We’ve set up dashboards and key performance indicators [KPIs] for the entire team.”

He says Logic Integration is progressing toward a two-year goal of having 20% of revenue from services. According to Hansson, “In years past, when we’ve been at Total Tech Summit, we’ve seen companies that have 20% or 30% services revenue. And those are some healthy companies. It really helps them avoid the project spikes—the peaks and valleys.”

At the same time, one mustn’t gloss over the challenges of reorienting an integration business to a services-centered model. “It’s a whole different mindset to go from a project-oriented company—an integrator that has come from the world of systems contracting—to being a solutions provider or a technology integrator,” NSCA’s Wilson acknowledges. “It’s not as easy as flipping a switch.” But just because it’s challenging doesn’t mean it’s impossible.

Wilson says that, in his estimation, roughly half the industry has made a real shift to becoming as-a-service or managed-services type companies. “They’re building the structure of their company and making investments to refocus on a monthly payment…a monthly service…service contracting,” he observes. “And those companies are doing really, really well.”

Leveling Up on IT Knowledge

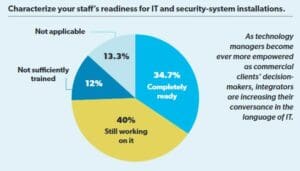

As noted, one reason that the services model has become so powerful is that it’s IT professionals’ native language, and our people are working with IT professionals more than ever. In our survey, we asked about staffers’ readiness for IT and security-system installations as a proxy for measuring integrators’ preparedness for speaking the language of IT.

As noted, one reason that the services model has become so powerful is that it’s IT professionals’ native language, and our people are working with IT professionals more than ever. In our survey, we asked about staffers’ readiness for IT and security-system installations as a proxy for measuring integrators’ preparedness for speaking the language of IT.

Nearly 35% of respondents described themselves as completely ready to jump into those projects; that marks a nearly six-percentage-point jump from our previous survey. Conversely, this time, only 12% described themselves as not sufficiently trained; in the previous survey, that was 25.4%, thus shaving away more than 13 percentage points.

NSCA’s LeBlanc, when asked to explain AV integrators’ increasing IT savviness, indicates that it is likely a client-driven phenomenon. “Customers are driving that shift, in large part, for integrators,” he says. “Customers are increasingly concerned about cybersecurity. For an integrator to work on their network, they want to feel that confidence.”

Integrators, therefore, are reacting to the new reality by making sure they’re bringing their teams up to speed. Logic Integration’s Hansson is working to leverage best practices in his own firm. “We always consult with the IT manager for the facility anytime we’re touching the network,” he states. “Each job site and customer get their own unique, newly generated password. This has helped, but it’s definitely not bulletproof.” Hansson adds, “Security is a very big concern in the world today, and we’re always learning how to better our team and projects.” Having an unquenchable thirst for IT knowledge may be a point of differentiation among integrators moving forward.

Vertical Markets

Commercial AV is organized around vertical markets, so it’s always instructive to get a sense of which are thriving and which lag. AVIXA’s Labuskes, drawing on the association’s own research, pinpoints corporate, retail and hospitality as the markets in which the highest percentage of companies are planning to increase their spending. “This is consistent with broader data showing these markets in recovery from last year’s pandemic-related declines,” he observes.

To some extent, AVIXA’s independent research echoes Commercial Integrator’s own survey. For example, when respondents were asked to forecast installation growth in various verticals this year, only 2.1% indicated they expect the corporate market to shrink, and just 16.2% more indicated they expect it to be flat.

Read: How Integrators Can Break into the Commercial Wellness Market

Meanwhile, 40.8% of survey takers forecast installation growth in the corporate market of 7% or more. Our survey, however, spotlighted other verticals as potential growth hubs—namely, education, government and healthcare. Percentages of survey takers forecasting 7% or more installation growth in those markets were 34%, 29.7% and 28%, respectively. (By contrast, for retail and bars/clubs/restaurants, our survey indicated that 14.8% and 14.7% of respondents, respectively, forecast 7% or more installation growth.)

For its part, NSCA research shows a commercial AV industry bouncing back from pandemic-related woes, with demand increasing across the board. According to Wilson, “Our data shows that every one of our verticals are going to be up from this past year.”

Supply Chain

If any single factor gives us reason to remain cautious, it centers on the supply-chain snarls that have been grabbing headlines for months. And, indeed, according to Commercial Integrator’s survey, the supply chain represents integrators’ main headwind as they enter the new year.

About 58% of respondents pinpointed it as the biggest challenge. AVIXA’s Labuskes remarks, “There are a lot of misconceptions out there about what’s going on and how companies should respond.” He notes that, commonly, people link supply problems to the chip shortage, but he argues that data from AVIXA’s third-quarter META shows that’s a bit of a red herring. “Instead,” Labuskes explains, “spiking demand, continuing COVID-19 and uncertainty are more important causes. Focusing on them will enable pro AV companies to identify problems sooner and develop better solutions from the beginning.”

Logic Integration’s Hansson lays out his firm’s strategy for dealing with supply-chain woes, describing it as a matter of “overcommunicating.” Hansson explains, “We’re having the conversation early—even at the first appointment.” Part of that conversation, he says, is strongly urging clients to order all their equipment immediately upon contract signing.

Related: CI Exclusive Video ISE, AVIXA Discuss ISE 2022 Postponement and Road Ahead

“That means payment terms have changed,” he acknowledges. “Instead of net 60, net 30 or 30-60-10 payment terms, we’re getting a lot more upfront. But we’re ordering the gear right away, and we’re staging it right away.” This not only protects an integrator’s cashflow but also puts the project in a better position to conclude on schedule.

NSCA’s LeBlanc reinforces the importance of considering supply-chain issues early. He says, “It’s important to go into 2022 with a mindset and a business approach that can accommodate these delays in product availability.” LeBlanc stresses that sales teams must be honest and transparent with customers, and integrators must be prepared to consider alternative products and solutions. “Otherwise,” he says, “you run into that having-to-apologize-later scenario, which leaves a negative feeling around the project and the relationship.”

NSCA’s Wilson adds that supply-chain issues are a double whammy because they also have a deleterious effect on integrators’ cashflow. He says, “We still have to keep our people employed. And, when they don’t have something to do, the supply chain is hurting us more on the expense side of the ledger than it is missing out on that revenue.”

Retaining Top Talent

That quandary is particularly difficult because, in recent years, commercial AV integrators have had a hard time finding qualified talent; thus, naturally, once they’ve found key personnel, they don’t want to lose them because of exogeneous events like supply-chain snarls.

In fact, according to Commercial Integrator’s survey data, 64.6% of respondents identified a lack of qualified candidates as the biggest challenge to filling open positions. Indeed, that answer drew nearly four times more response than the second-most-popular answer: candidates’ salary demands.

The solution to the problem is three-pronged: making more people aware of AV as a career opportunity, improving how we recruit talent and enhancing company culture. On the last point, Logic Integration’s Hansson says, “We’re hiring a culture consultant, and they’re going to spend a year with us in 2022 on our core values and embracing them every single week.” Hansson has also instituted programs for employees to encourage them, for example, to improve their financial health vis-à-vis paying off personal debt. Those company-culture investments redound to Logic Integration’s benefit by yielding a stronger, more focused, more cohesive team.

Download: The 2021 Class of 40 Under 40 is Here!

But before an integrator can enhance its strong team, as Logic Integration is doing, it must first build that strong team. That means attracting people to our industry. “People still don’t know that we exist as a great career choice,” NSCA’s Wilson laments. “We still have so much work to do with regard to awareness of the profession that we’re in.”

Critically, however, NSCA is working diligently to raise that awareness; the cornerstone of its efforts is the Ignite initiative. LeBlanc remarks, “That program is designed to arm integrators and ambassadors to go out and do a better job of casting a wide net with educating people about career opportunities in this market.”

And on the topic of casting a wide net, LeBlanc underscores that integrators must continue to be mindful of their diversity, equity and inclusion (DEI) policies, particularly as they relate to recruitment. NSCA is investing in its DEI Action Council to trumpet that message. These efforts might be critical to appealing to students and young professionals.

Although one cannot doubt that the commercial AV industry continues to face challenges, the data paints an unequivocal picture: The bounce back has begun. As transitory depressors like inflation and the supply chain begin to ease up, commercial AV integrators will be in prime position to soar.