Audio consultancy and networking experts RH Consulting (RHC) have released the 2024 edition of the report on Networked Audio Products — extended to cover also audio, video and control products — which confirms the growing strength of AES67, RAVENNA and ST 2110 and the dominance of Dante and NDI standards. According to the company, its been counting networked audio products and licensees since 2013 to chart the adoption and evolution of audio networking in the pro audio, AV and broadcast markets.

In the dynamic landscape of networked AV, RH Consulting reveals that the 12th instalment of the report witnessed a significant surge in overall adoption, with a total of 6,013 products from 602 brands. This comprehensive analysis thus sheds light on emerging trends and market dynamics.

“A milestone has been reached with over 6,000 networked AV products on the market and with video-over-IP products numbering more than 1,000,” reflects Roland Hemming, audio consultant at RH Consulting. “Networked media products are steadily becoming part of everyone’s work. Soon it will be easier to count the remaining analogue products!”

Report Highlights

The research confirms that Dante, the audio networking technology, has experienced remarkable growth over the past 12 months. Per a statement, it has showcased an 11% expansion in audio products. With 4,131 products, Dante outpaced all other protocols combined, introducing 420 new products and involving 45 manufacturers for the first time.

On the other hand, AES67, an interoperability standard, reached 4,380 compatible products, supporting various protocols such as Dante, RAVENNA, Livewire+, Wheatnet and ‘raw’ AES67. The report finds that the majority of Dante solutions likely support AES67, indicating a high level of integration in the market.

Per RH Consulting, RAVENNA, showed steady growth across the year and secured the second-highest increase in audio products with 344 offerings. MILAN and AVB also demonstrated growth, with MILAN-compliant products increasing to 45.

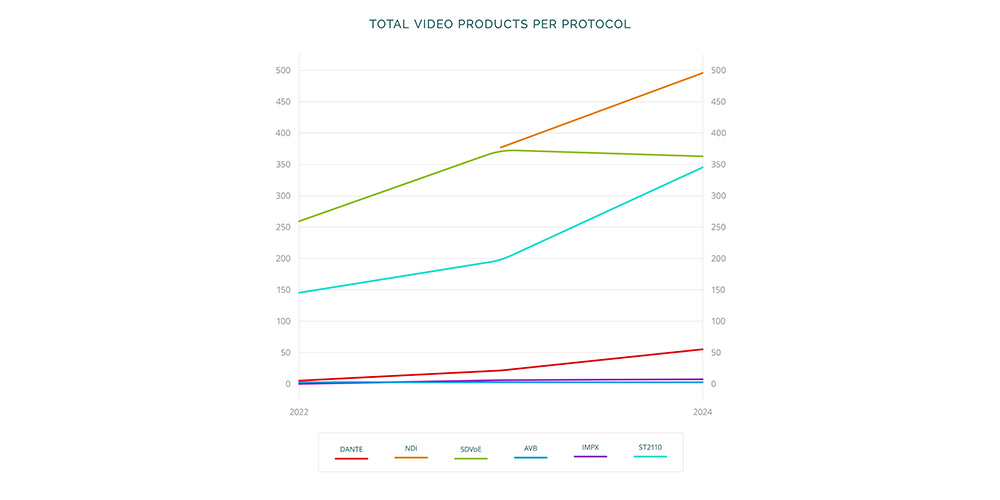

In the video-over-IP realm, the company says the market is still maturing compared to networked audio. The report analyses protocols such as NDI, SDVoE, ST 2110, Dante AV, IPMX and AVB, revealing insights into their adoption and maturity.

Additional Insights

NDI emerged as the leader in terms of product numbers with a total of 494. ST 2110 experienced substantial growth with 344 encoder and decoder products, while Dante AV, a relative newcomer, tripled its product numbers in just 18 months, totaling 62 products.

SDVoE, despite a small decline, maintained a significant presence with 364 products. IPMX ‘ready’ products, totaling seven offerings, indicate potential growth upon full protocol release.

As the market matures, RH Consulting states that major players are yet to fully embrace video-over-IP standards, raising questions about the industry’s future direction. The report invites stakeholders to consider the evolving landscape and adapt to emerging trends in networked AV technology.

“We now have three years of data for video products so we can start to draw a line,” concludes Hemming. “Other than overall growth, we still can’t identify a ‘winner’ for AV-over-IP. Several major video manufacturers are still using proprietary technology — is it time for them to jump off the fence and commit to offering real interoperability?”

For a full breakdown of all the statistics and a comprehensive listing of all the protocols considered and how the data is compiled, view the full report.