Every year, Commercial Integrator partners with NSCA to deliver an update on the state of the commercial AV industry, examining the challenges that integrators face, the strides they’ve made and the opportunities that lie ahead. As the calendar flips to 2023, the landscape for integrators appears somewhat uncertain…perhaps even treacherous. After all, worldwide inflation has spurred talk of a possible recession, supply chains are still snarled and integration businesses continue to wrestle with vexing talent issues. On the flip side, however, commercial AV technology is now recognized — perhaps more than ever before — as mission critical to delivering the kind of experiences that people want and expect. That means integration businesses can and should lean into the value they provide, and price their services accordingly. To paraphrase Tom LeBlanc, NSCA’s executive director, it’s a challenging time to be an integration business owner, but it’s also a great time to be an integrator.

CI and NSCA surveyed nearly 150 owners and operators to better understand the health of their integration businesses, as well as to draw conclusions about the commercial AV market overall. This report draws on that data, while also offering detailed analysis from NSCA CEO Chuck Wilson, LeBlanc and other industry stakeholders.

Although we usually start the State of the Industry report with topline figures about revenue and the business climate, the challenges this year are so specific and acute that it makes sense to begin by tackling them. Our survey indicates that 83.6% of integrators believe that inflation and escalating costs are a top-tier concern in 2023. “It was the pandemic and COVID-19 hanging over our head,” Wilson laments. “Now, it’s interest rates and inflation hanging over our head. There just is always something!”

One of the clearest ways that inflation harms integration businesses is that true project costs can quickly change, resulting in once-profitable jobs ending up upside down. Citing wage inflation, price increases, logistics costs, fuel surcharges, etc., Wilson remarks, “You’ve got all of these things that just incrementally added a whole bunch of costs to the fixed and variable cost of doing that project.” Accordingly, he says, many integrators are racing to pull quotes off the street and reprice them. In fact, Wilson notes, one NSCA member recently had its sales team pull 200 quotes off the street, retracting them as soon as the expiration date hit. Of course, clients aren’t likely to be happy when they’re asked to take on these added costs, but Wilson underscores that every trade is having to make these adjustments to stay in business.

Rising interest rates are just as problematic for integrators, most of whom work off a line of credit, pledging against their receivables or their inventory. Wilson mentions rising mortgage rates, which have more than doubled from 3% to approaching 7% in the past 18 months, and he says integration businesses face an analogous situation with their lines of credit. Integrators are commonly having to pay an extra couple thousand dollars a month in interest, and most didn’t have those interest rates in mind 18 months ago as they were preparing bid documents. This situation is forcing integrators to make hard choices, particularly with respect to bonded projects. “In a lot of cases, we’re better off buying our way out of that job than we are to take that project,” Wilson acknowledges candidly.

Supply-Chain Snarls

Nearly 83% of integrators say that lingering supply-chain problems are a major challenge for their businesses. However, both Wilson and LeBlanc acknowledge the resilience that integrators have shown. Calling integrators’ adaptability to alternative products and substitutions nothing short of remarkable, Wilson says, “Months ago, they started to work with the designers, specifying engineers and consultants to make sure that they’re not proposing or designing things that they just can’t get.” Those workarounds, he says, continue to fuel optimism.

Wilson and LeBlanc concede that there’s no snap-your-fingers solution to the supply chain; instead, there are risk-mitigation techniques and proactive strategies to maximize businesses’ chances of succeeding. LeBlanc immediately points to better contract language, such as ensuring the presence of force majeure language and waiver of remedies clauses to protect against liquidated damages and related penalties. He also exhorts integrators that they should be, “Doing a better job of inventory management and trying to get good at projecting needs so that you can stock products that you know are going to be needed, as you analyze your pipeline.” This relates to the shift from “just in time” to “just in case” but underscores that integrators must have a strategy based on insights into when “just in case” inventory will be needed. “One of the keys to success as integrators continue to work through the supply chain is how well they can do that,” LeBlanc adds.

Finding and Retaining Talent

More than 72% of integrators say talent issues are among their top concerns this year. In particular, business owners are finding it challenging to attract and retain key employees. The biggest problem is a lack of qualified candidates; indeed, 73.3% of survey respondents say that’s the principal challenge they face in filling open positions. If you ask LeBlanc, commercial AV’s insularity is the problem. “This industry exists in a bubble,” he declares. “And, inside the bubble, we all know about the great career opportunities that can be had in the integration market. We know how rewarding careers can be. But, outside of the bubble, people don’t know about this industry.”

Technical schools today are turning out highly trained, enthusiastic, promising young talent; regrettably, the commercial AV industry isn’t even on the radar for many of them. “We need to go outside of the bubble and educate people about this industry in order to create a better pool of candidates,” declares LeBlanc, who says it’s time to stop bemoaning how hard it is to recruit in this industry and, instead, try to improve the situation. NSCA is leading the charge with its Ignite initiative, which seeks not only to spark interest in our industry but also to build out internship opportunities, bringing together young candidates and leading integration businesses. NSCA members have become ambassadors for our craft and trade, acting as feet on the street at career fairs and colleges. According to LeBlanc, “The internship program is unique because it’s designed specifically to incubate people into the company culture and to this industry. So, if they come in through that robust internship program, there’s a better chance that they’re going to end up being a good employee.”

Technical schools today are turning out highly trained, enthusiastic, promising young talent; regrettably, the commercial AV industry isn’t even on the radar for many of them. “We need to go outside of the bubble and educate people about this industry in order to create a better pool of candidates,” declares LeBlanc, who says it’s time to stop bemoaning how hard it is to recruit in this industry and, instead, try to improve the situation. NSCA is leading the charge with its Ignite initiative, which seeks not only to spark interest in our industry but also to build out internship opportunities, bringing together young candidates and leading integration businesses. NSCA members have become ambassadors for our craft and trade, acting as feet on the street at career fairs and colleges. According to LeBlanc, “The internship program is unique because it’s designed specifically to incubate people into the company culture and to this industry. So, if they come in through that robust internship program, there’s a better chance that they’re going to end up being a good employee.”

Related: Interns: The Leaders of Tomorrow

Wilson runs with the topic of company culture, saying that many AV businesses that do manage to attract outstanding talent end up quickly losing them because of inadequate onboarding. “We assume that, because they have 10 years of experience, off they go,” Wilson says, calling this a huge missed opportunity. It’s essential, he believes, to train new team members to be great employees at your company, rather than simply being satisfied that they were competent at what they were doing before. “So many times, we forget that we have to bring them into the onboarding process of the company,” Wilson laments, rattling off culture, core values, mission, vision and other differentiators into which employees must immerse themselves. “What you do with that employee for the first six weeks is so vital in determining how long they’re going to stay with you,” Wilson declares.

Corporate Lattice vs. Corporate Ladder

LeBlanc notes the volatile labor market, saying, “We’ve seen a lot of jumping around — even more so than in the past.” Thus, integration businesses should develop a strategy to hang onto the talent they’ve successfully attracted. That might entail jettisoning the corporate ladder in favor of the corporate lattice. “The idea of a lattice is, you don’t have to lose your A-level performers just because they get bored in their job, or they want to try something different,” he says. “It’s about sliding them over, training them and giving them a good chance to be successful in a different part of the business.” This strategy helps integrators hang onto top talent who, otherwise, might feel locked into a narrow career path.

“Try to show those people that there is a rewarding career no matter where you’ve started,” Wilson adds. “We have to demonstrate that our industry [offers] such a great opportunity to start here and go anywhere, all the way up to maybe one day running your own company.”

Optimism Prevails

Optimism Prevails

With integration businesses clearly facing a litany of challenges, one might reasonably suspect that integrators are a bit wary of what 2023 will hold. On the contrary, the CI and NSCA survey indicates integrators are bullish not only about the present but also about the future. Asked to describe the current business climate, a combined 35% of respondents say it’s either excellent or very good, with another 48.9% describing it as good with some reservations. Only one in 10 say the business climate is challenging. “We’re in this stage where what an integrator offers to their customers is more valuable now than it has ever been before,” LeBlanc declares, pointing to customers across verticals assessing what technologies to invest in post-pandemic. In that sense, we have, indeed, become mission critical. “The demand for what we do is high,” Wilson says plainly. “We do stuff that people want.”

If you ask Ray Bailey, president of Lone Star Communications and president of the NSCA Board of Directors, there is a real opportunity for integrators to recognize trends and take advantage of them. “I can tell you, in healthcare, there is such a drive to improve the patient experience that there’s a lot of money being spent,” he declares. “You see it in movement of patient rooms, lobbies, expanding visiting hours…you just see a real push. And a lot of it is the fact that we have so many people getting older and that there is a need for new patient rooms.” Remarking on the number of new hospitals being built, he says, “Every one of them is using technology to improve the patient experience.”

LeBlanc hastens to add that this phenomenon isn’t by any means exclusive to healthcare. “You can say the same thing about just about every market,” he says. Integrators that are well positioned to meet their clients’ abundant and evolving needs are likely to have a great 2023.

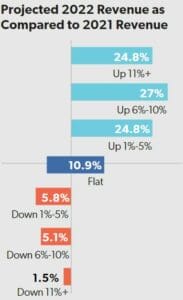

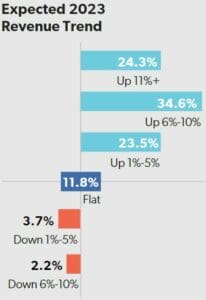

Year-to-Year Revenues

Bullishness also reigns with regard to integrator respondents’ revenue forecasts. When survey-takers look at projected full-year 2022 revenue versus 2021 revenue, 76.6% of them indicate an up year, with another 10.9% forecasting a flat 2022. Only 12.4% of integrators believe that 2022 will end up having been a down year — a rather remarkable statistic, given the challenges we’ve taken pains to explore. What’s more, as integrators look to 2023 full-year revenue, they evince even greater optimism. Indeed, 82.4% of respondents believe this will be an up year for their business, with another 11.8% forecasting flat revenue. Only 5.9% of survey takers believe this will be a down year for them, and, of those, none forecasts a revenue decline exceeding 10%.

Bullishness also reigns with regard to integrator respondents’ revenue forecasts. When survey-takers look at projected full-year 2022 revenue versus 2021 revenue, 76.6% of them indicate an up year, with another 10.9% forecasting a flat 2022. Only 12.4% of integrators believe that 2022 will end up having been a down year — a rather remarkable statistic, given the challenges we’ve taken pains to explore. What’s more, as integrators look to 2023 full-year revenue, they evince even greater optimism. Indeed, 82.4% of respondents believe this will be an up year for their business, with another 11.8% forecasting flat revenue. Only 5.9% of survey takers believe this will be a down year for them, and, of those, none forecasts a revenue decline exceeding 10%.

Related: State of the AV Industry 2022: The Bounce Back

Given the exogeneous factors that have been weighing on integrators the last several months, this revenue bullishness calls out for examination. According to Wilson, one explanation for frothy growth might be the substantial weakness of 2020 and 2021 amid lockdowns, halted sitework and travel encumbrances. Indeed, he notes that, if you look back at pre-pandemic growth projections, it’s almost as though 2022 and 2023 have picked up where 2019 left off; by that light, 2020 and 2021 could be described as “lost years” for integration businesses. Many of the projects put on hold during the pandemic are back on track now, empowering integrators to reclaim those revenues. “The ones that survived [the pandemic era], I think they’re going to have a great future,” Wilson declares.

But there are clearly crosscurrents and contradictions, and those are on full display in D-Tools Cloud data provided exclusively to CI. According to D-Tools’ CEO, Randy Stearns, overall proposal activity industry-wide remains steady and has even increased slightly year over year as compared to 2021, but close rates were down 10% to 12% in the first half of 2022 and closer to 15% these past four months as compared to the same period in 2021. This indicates that buyers are exhibiting more caution. So, CI, too, looks to the year ahead cautiously.

The Back End of Projects

Here’s one good reason to remain cautious: Even if integrators are busy doing lots of projects, there’s no assurance that those projects are actually profitable. NSCA and CI survey respondents indicate that their project pipelines are flush, with 68.6% saying their backlog is up as compared to this time last year. (Notably, nearly half of those who report that say that their backlog is up significantly.) Thus, we can feel confident that integrators’ engineering, installation and commissioning teams will have plenty on their plates over the next 12 months. But LeBlanc sounds the alarm that project profitability is vulnerable, and integrators must be proactive. “Look at this great revenue opportunity as a call to action when it comes to prioritizing back of house,” he advises.

Here’s one good reason to remain cautious: Even if integrators are busy doing lots of projects, there’s no assurance that those projects are actually profitable. NSCA and CI survey respondents indicate that their project pipelines are flush, with 68.6% saying their backlog is up as compared to this time last year. (Notably, nearly half of those who report that say that their backlog is up significantly.) Thus, we can feel confident that integrators’ engineering, installation and commissioning teams will have plenty on their plates over the next 12 months. But LeBlanc sounds the alarm that project profitability is vulnerable, and integrators must be proactive. “Look at this great revenue opportunity as a call to action when it comes to prioritizing back of house,” he advises.

In particular, LeBlanc urges integrators to leverage the NSCA Financial Leadership Council to shore up their competency in navigating the supply chain, project scheduling, cashflow projections, staffing decisions and inventory management. Wilson observes that, for years, our industry has equated busyness with success; however, they’re not always the same thing.

Asked for a metric to evaluate the healthiness of backlog, Wilson replies, “The anticipated gross profit on that project versus what the reality will be by the time you get it in and billed.” He adds that integrators need to spend time poring over work-in-progress (WIP) reports and considering, “Of that backlog that’s sitting there, how much are we going to bill this month, this month and this month?” LeBlanc underlines the point, saying that, if integrators’ backlogs are bursting, “We think they should get really smart about [back-of-house issues] to make sure this is a positive for them.” Fortunately, NSCA has a constellation of tools and resources to help integrators in all these areas.

Considering Margins

Of course, higher interest rates and global inflation can cause gross-profit-margin erosion, but so, too, can some integrators’ tendency to devalue themselves by racing to the bottom on pricing. This tendency manifests itself in our survey results, with 57.3% of respondents indicating that their hardware margin on projects is 20% or less. Stunningly, 8.8% report their hardware margin is less than 5%. “Those companies that report that are taking on bad projects,” Wilson says candidly of that group. “They’re devaluing the important things that they’re doing. They’re not providing their company with the resources it needs to stay in business.” He uses the phrase “working for wages” to describe this approach, saying that, unless an integrator’s labor rates are astronomical, incredibly low hardware margins are inimical to building true equity in your business.

As with everything else we’ve discussed, there’s nuance here, too. Additional D-Tools Cloud data, provided exclusively to CI, paints a more propitious picture. Stearns, the CEO, reports that, across nearly 250,000 product purchases, product margins across all product categories in 2022 came in at an impressive 45.8%. He notes that speakers, lighting controls, window treatments and security systems achieved superior margins — each in excess of 50% — whereas videoconferencing (22.5%), AV sources (36.6%) and displays (37.9%) fell well below the average. Stearns adds that, according to the D-Tools Cloud data, labor margins across the board are averaging 55.6%, a healthy number consistent with historical norms.

Video: The Biggest Mistake Integrators Make When Selling Technology-as-a-Service

The apparent contradiction here might be explained, in part, by the composition of respondents to the NSCA and CI survey. A majority of them (54%) represent integration companies of 50 or fewer employees, and more than a third of that group represent companies with fewer than 10 team members. Concomitantly, many survey respondents are also on the lower side revenue-wise, with 44.5% of participants reporting $5 million or less in projected full-year 2022 revenue. Smaller integrators might not have the purchasing power to realize the most favorable margins, and their teams might not have in-house financial experts to optimize the profitability posture of each project. On this latter point, LeBlanc notes, “The financial leaders of integration companies are the ones who need to take a hard stance to make sure they’re only taking on projects that have a chance to be profitable.” And profitability starts with having healthy hardware margins.

Selling Services

As integrators consider the need to ensure healthy margins to protect project profitability, they should also evaluate whether now is the time to fully lean into selling services — from something as simple as a “break-fix” service contract to something as ambitious as AV-as-a-Service (AVaaS). Both CI and NSCA have been beating this drum for years, but the pandemic was truly the proof point. Simply put, integration companies with strong recurring revenue fared much better and maintained stronger customer relationships.

Among our survey respondents, 57.6% indicate that they forecast 10% or less of their 2023 revenues to derive from selling services. “We’d like to see that tick up,” LeBlanc says. “It seems like, in most cases, integration companies are in a position to try to provide service on an ongoing basis and to make sure they’re being compensated for that.” He makes the point that some integrators simply aren’t ideally equipped to adopt full-on AVaaS, but there are manifold ways for integrators to pivot to a service-minded approach.

Among our survey respondents, 57.6% indicate that they forecast 10% or less of their 2023 revenues to derive from selling services. “We’d like to see that tick up,” LeBlanc says. “It seems like, in most cases, integration companies are in a position to try to provide service on an ongoing basis and to make sure they’re being compensated for that.” He makes the point that some integrators simply aren’t ideally equipped to adopt full-on AVaaS, but there are manifold ways for integrators to pivot to a service-minded approach.

Of course, if an integrator decides to dive headlong into selling services, it’s essential that the initiative is a profit center, not a cost center. Thus, LeBlanc says, it’s imperative that the integrator spend plenty of frontend time with legal to make sure everything is set up properly — that is, that the company is protecting its interests, it’s creating the right contracts and it’s making the right service arrangements. One strategy is to forge a partnership with a recognized organization and leverage its expertise. LeBlanc recommends Revenueify, which is part of NSCA’s Member Advisory Council, as a potential partner. “They work with integrators on how to sell managed services,” he explains. Another option is to utilize resources like “Anatomy of a Successful MSP,” a paper that NSCA produced in collaboration with PSA Security Network. “It identifies common steps that successful recurring-revenue integrators have taken to put themselves in that position,” LeBlanc states.

Related: Revenueify on Helping Integrators Achieve RMR

Ultimately, if integrators want to realize the margin and cashflow benefits of selling services, they must prepare extensively, rather than trying to wing it. When integrators have to pull installers and technicians off a project to do service work, it can easily result in projects going over hours and being inefficient. “You need to get over that hump or cross that chasm to dial up a standalone service business,” Wilson advises. But he strongly believes that the initial investment of time and effort will pay huge dividends. “The [integrators] that are geared up for this love taking service calls,” Wilson declares, “because they know for sure the differential between project-based gross profit and service-based gross profit.”

Final Thoughts

D-Tools’ Stearns, analyzing the D-Tools Cloud data provided exclusively to CI, captures the confluence of countervailing forces here. He says, “At a high level, the data indicates that systems integrators remain as active and busy as ever, but that caution in the marketplace — presumably, due to economic uncertainty — has slowed decision making; hence, contract approvals are down or delayed. This pause in approvals, however, does not seem to be impacting proposal activity or pricing levels, suggesting that projects are not being halted or suspended as of yet.”

As we look to the year ahead, inflation seems likely to be the biggest threat to integrators’ financial stability. Thus, LeBlanc offers some salient advice: “Integrators need to forecast and budget appropriately to stay in sync with inflation.” That means not only pricing proposals appropriately and ensuring there’s sufficient margin to ensure profitability but also recognizing that, to achieve genuine growth this year, it’ll be necessary to grow beyond the rate of inflation.

Wilson acknowledges that much of our industry’s fate lies outside of our hands, mentioning Federal Reserve policy with regard to interest rates, the consumer confidence index, employment numbers, the chip shortage, etc. But, on balance, he sees more upside than downside. “If we have a soft landing from the financial picture that we’re in right now, then I think, a year from now, we’re going to be feeling pretty darn good,” Wilson says with a smile. And if integrators — the experience-creators, memory-makers and smile-generators of our society — are doing well, that redounds to the benefit of us all.

It is, indeed, a challenging time to be an integration business owner, but a great time to be an integrator.