One thing that unites Commercial Integrator and our partners at NSCA is our shared commitment to helping integrators run their businesses better and more profitably. The best way to do that is to look at all facets of the integration trade analytically — where we’ve been, where we are and where we, together, hope to go. That’s why, every year, CI and NSCA partner to deliver a “State of the Industry” report. This report, which draws on an exclusive research study, as well as thought-leader comments from NSCA executives, offers up-to-the-minute data on hot topics like backlog, project profitability, margins, recurring revenue and IT readiness. Our goal is to empower integrators — all of you who are always so busy working in your business — to take a moment to work on your business.

Reasons for Optimism

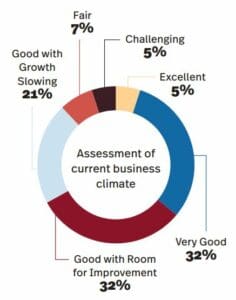

This year, the big picture is mixed, although with plenty of reasons for optimism. Our survey respondents have a fairly rosy view of the overall business climate, with 32% describing it as very good, 32% saying good with room for improvement and another 5% saying it’s excellent. A mere 5% of respondents describe the business environment as challenging. What’s more, in response to a question about total projected revenue for 2023, 78% of respondents project an up year versus 2022. In fact, 39% project they’ll be up 11% or more. Moreover, when asked about anticipated revenue trends in 2024, survey takers are even more optimistic. More than 80% of respondents are forecasting an up year. And, in fact, 18% expect to see revenue growth of 11% or more.

This year, the big picture is mixed, although with plenty of reasons for optimism. Our survey respondents have a fairly rosy view of the overall business climate, with 32% describing it as very good, 32% saying good with room for improvement and another 5% saying it’s excellent. A mere 5% of respondents describe the business environment as challenging. What’s more, in response to a question about total projected revenue for 2023, 78% of respondents project an up year versus 2022. In fact, 39% project they’ll be up 11% or more. Moreover, when asked about anticipated revenue trends in 2024, survey takers are even more optimistic. More than 80% of respondents are forecasting an up year. And, in fact, 18% expect to see revenue growth of 11% or more.

Tom LeBlanc, executive director, NSCA, says that integrator optimism itself augurs well for what the year ahead will hold. “Usually, company owners are correct,” he observes. “If they feel good going into a year, it tends to be a pretty good year.” Integrators, after all, can gauge how busy they’ll be by assessing their backlog versus prior years’ booked work.

It also seems as though our survey’s integrator optimism isn’t a mere anomaly; in fact, NSCA’s biennial Financial Analysis of the Industry captures exactly the same sentiments. A majority of those respondents rated their company’s financial health as good to very good, data that actually shows improvement as compared to the sentiment captured in late 2019. Integration business owners aren’t blind to all the profitability challenges and moving parts, LeBlanc emphasizes. But, he adds, “Typical integrators still feel really good about their company’s financial health.”

Considering Backlog

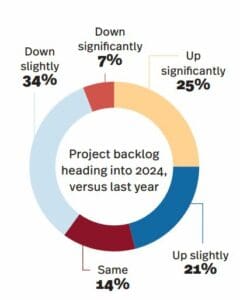

As noted, one way that integrators can forecast the year ahead is to look at their booked work for the coming months. That’s why, every year, we ask integrators a question about their backlog. This year’s results actually flash a warning sign. Even though 46% of integrator respondents report an increase in backlog as compared to the same time last year (including 25% reporting a significant increase), another 41% report a year-over-year decrease in backlog. In fact, the plurality response (34%) is that backlog is down slightly. In response to our question about which types of projects are in respondents’ backlog, our integrators overwhelmingly say acoustics, audio and AV projects, with 75% of survey takers indicating that those projects are in queue. The next-closest answer is digital signage, which 36% of respondents have in their backlog. Some other project categories (e.g., building automation and control, life safety) barely crack double digits.

As noted, one way that integrators can forecast the year ahead is to look at their booked work for the coming months. That’s why, every year, we ask integrators a question about their backlog. This year’s results actually flash a warning sign. Even though 46% of integrator respondents report an increase in backlog as compared to the same time last year (including 25% reporting a significant increase), another 41% report a year-over-year decrease in backlog. In fact, the plurality response (34%) is that backlog is down slightly. In response to our question about which types of projects are in respondents’ backlog, our integrators overwhelmingly say acoustics, audio and AV projects, with 75% of survey takers indicating that those projects are in queue. The next-closest answer is digital signage, which 36% of respondents have in their backlog. Some other project categories (e.g., building automation and control, life safety) barely crack double digits.

That level of AV-centricity actually might help to illuminate why our research is somewhat less bullish on backlog than NSCA’s own (through its Financial Analysis of the Industry) is. “[Yours] is a highly AV-centric response,” Chuck Wilson, CEO, NSCA, says. (NSCA’s mix, by contrast, is closer to 50/50 between AV and security integrators.) This perhaps reflects that more AV-focused companies have less backlog than more diversified integration businesses do. Indeed, if you ask LeBlanc and Wilson, insufficient booked work is not a major problem for NSCA integrators at the dawn of 2024, even as many integrators have burned through the glut of work they’d built up during the peak of supply-chain woes.

Related: Digital Signage: A Complete Guide

“We have heard mostly positive things from integrators about optimism related to backlog,” LeBlanc reiterates, pivoting to the challenge he does hear integrators lamenting. “I think the concerns are more about making sure those projects are executed profitably.”

A huge integration opportunity exists between AV, digital signage and security now. Increasingly, the systems are all interoperable and capable of working together. Framestock/stock.adobe.com

Empowering Financial Leadership

For years, NSCA has driven the message that integration business owners must empower their financial leadership to ensure every project has a strong profitability posture. This is a passion for Wilson, who speaks eloquently on the issue. “The key is to go into a project where your anticipated gross margin is managed to where your actual gross margin is the same number or better,” he explains. That’s easier said than done, especially amid so many sources of margin erosion (e.g., surcharges, inflation, schedule changes).

Wilson emphasizes that integrators mustn’t ever confuse being busy with being successful. “There’s a huge difference between activity and positive, successful results on projects,” he warns. Wilson urges constant vigilance against margin erosion and encourages proactive measures (e.g., change orders) to combat it.

Wilson emphasizes that integrators mustn’t ever confuse being busy with being successful. “There’s a huge difference between activity and positive, successful results on projects,” he warns. Wilson urges constant vigilance against margin erosion and encourages proactive measures (e.g., change orders) to combat it.

One way that integrators can potentially realize greater profitability on projects is to enmesh themselves in more aspects of a client’s physical environment. LeBlanc touts the idea of becoming a “master systems integrator.” As he explains, “There are a lot of opportunities for commercial integration companies to expand what they do with their existing customers.” Traditional AV integrators might limit their project purview to UC&C, for example. By contrast, LeBlanc says, master systems integrators “…get more involved in the overall building solution.” That might involve HVAC monitoring, taking ownership of the building’s healthy systems, etc. Ultimately, it’s about being a one-stop solution that provides all the systems that make people feel comfortable in the building.

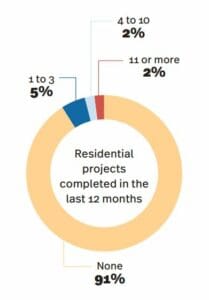

The master systems integrator approach serves as a counterpoint for those who espouse resimercial as an ascendant opportunity. Our survey respondents, for their part, do not register much interest at all in residential work. Indeed, 91% of survey takers say that they didn’t complete a single residential project in the past 12 months. Another 5% say they completed between one and three residential jobs. “Perhaps the high ceiling for integrators is not to expand to other customer groups,” LeBlanc avers. Instead, he urges integrators “…to look more at what they can do to provide greater and wider solutions for their existing customers.”

The master systems integrator approach serves as a counterpoint for those who espouse resimercial as an ascendant opportunity. Our survey respondents, for their part, do not register much interest at all in residential work. Indeed, 91% of survey takers say that they didn’t complete a single residential project in the past 12 months. Another 5% say they completed between one and three residential jobs. “Perhaps the high ceiling for integrators is not to expand to other customer groups,” LeBlanc avers. Instead, he urges integrators “…to look more at what they can do to provide greater and wider solutions for their existing customers.”

Security Might Be Another Story

Going deeper and wider with commercial clients could well mean dipping a toe in the physical and electronic security world. “We’re seeing a huge integration opportunity between AV, digital signage and security now,” Wilson observes, “because the systems are all interoperable and working together.” Thus, especially at a time when active-shooter situations are tragically frequent, it’s only natural to pair discussions about campus signage and mass notification, for example, with conversations about video surveillance, access control, intrusion detection and other security measures. And with commercial clients increasingly recognizing that AV is likewise mission critical, they’re primed to assign high value to what AV integrators have to offer.

Already, we see 18% of survey respondents reporting that they have physical security projects in their backlog for 2024. This just reinforces Wilson’s perspective. “Our sweet spot isn’t [in residential],” he declares. “It’s in industrial manufacturing, education, healthcare, government — that’s where we belong.”

Already, we see 18% of survey respondents reporting that they have physical security projects in their backlog for 2024. This just reinforces Wilson’s perspective. “Our sweet spot isn’t [in residential],” he declares. “It’s in industrial manufacturing, education, healthcare, government — that’s where we belong.”

One thing that AV integrators perhaps could learn from physical and electronic security specialists is the importance of selling services and earning RMR. At present, our research study shows relative stagnancy in terms of integrators shifting to a services-driven business model. Some 47% of respondents say that service contracts made up less than 5% of their revenue last year. Another 28% peg the number at 5% to 10% of 2023 revenue. And although 79% of survey takers report selling service contracts, the percentages associated with more robust service offerings are comparatively weaker: managed services (44%), AV-as-a-Service/AV-as-a-Subscription (16%) and security monitoring/video storage (14%). Meanwhile, a surprising 9% of survey takers report that they don’t sell any services at all.

A Change in Posture

“For whatever reason, audiovisual systems are not being sold as something that needs to have a managed-service agreement attached to it,” Wilson laments. “That couldn’t be further from the truth.” Indeed, he points to the ubiquitous need for patches, fixes, updates and software enhancements, which are critical to system viability. To shake up that mistaken mindset, NSCA recommends a change in integrators’ posture. Instead of offering a service contract as an add-on sale, Wilson recommends integrators make it so that the client must go through steps to opt out of a service contract. “Show them the obligation as the end user [of not having that],” he stresses, emphasizing how costly the wrong decision could be.

Watch Recording: CI and NSCA’s Annual State of the Industry Webcast

“We’ve been monitoring this question [about service-based revenue], really, since the beginning of the State of the Industry report,” LeBlanc, who used to be editor-in-chief of Commercial Integrator, observes. “We haven’t seen the needle move as much as we would like [it] to.” Some of this might have to do with the increasing prevalence of AV departments (or AV-savvy IT teams) at major clients, whose presence can make managed services a tougher sell. Nevertheless, if you ask LeBlanc, integration businesses moving to sell services is increasingly becoming critical to remaining relevant to customers and their evolving needs. What once was a conversation meant to improve integrator cash flow and produce higher revenues has now, arguably, become existential. “Customers want and need a solution that provides ongoing confidence that the systems are going to work,” he adds. “Nowadays, [AV systems] are perceived to be a lot more mission critical than they used to be.” Speaking plainly, it’s difficult to be an outcome guarantor without selling the services that guarantee positive outcomes.

Wilson reflects candidly on prior decades, when NSCA and its membership had a somewhat different posture. “Truthfully, we were installers,” he recalls. “Good at putting stuff in, and you just hoped it went in smoothly. Then, you walked away to the next project.” With a chuckle, he adds, “Those times have changed.” Now, Wilson says, an integrator’s proper role is that of a trusted advisor. “Integrators are now poised to have a seat at the adult table,” LeBlanc adds, “because of the relevance of what they’re providing in terms of solutions.” But AV integrators must constantly earn that seat at the adult table by playing an active, more consultative role.

The education vertical remains a strong focal point for integrators. Indeed, among survey respondents, 82% expect to experience growth in this vertical market in the coming 12 months. Kasto/stock.adobe.com

Bread-and-Butter Markets

According to our exclusive research study, most integrators expect 2024 to be a year in which they lean into tried-and-true, bread-and-butter markets. For example, not a single respondent expects to see a down year in the education vertical, with 82% expecting to experience growth in the coming 12 months. The same is true of corporate work: Zero respondents expect a drop in the coming year, whereas more than 80% expect to enjoy growth. (In fact, on the corporate side, 18% say they expect to experience growth exceeding 11%.) Healthcare is another bright spot, with 76% of survey takers forecasting a growth year in that vertical. By contrast, bearish forecasts prevail in the bars/clubs/restaurants vertical (85% down or flat) and the retail vertical (78% down or flat). Casinos/hotels also show relatively weak sentiment, with 70% of survey takers forecasting a down or flat year.

LeBlanc, citing NSCA’s biannual Electronic Systems Outlook report, which monitors construction starts, affirms those results, saying they mostly mirror our own research data. He adds, however, that one vertical market not among our answer choices — manufacturing — registered especially robust potential for growth in the Electronic Systems Outlook. “One of the reasons for that,” LeBlanc explains, “is the focus on reshoring manufacturing.” So, even though factories and manufacturing facilities might not make up a huge slice of the pie for integration businesses, they’re an area where opportunities are particularly robust.

Hardware Margins

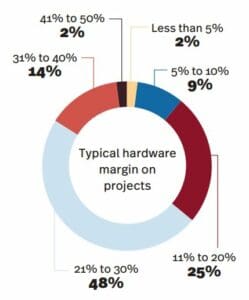

Although NSCA, by its nature, cannot get too deep into conversations about margin, the association compellingly encourages integrators to recognize the value that they bring — and to price their offerings accordingly. One area where concern about value manifests itself is hardware margins. Looking at our survey data, the plurality response (margins of 21% to 30%) is relatively healthy — and it’s certainly positive to see a combined 16% of survey takers say their hardware margins exceed 30%. However, it’s somewhat troubling that 36% of respondents report margins of 20% or below — including a combined 11% who report margins of 10% or less.

Although NSCA, by its nature, cannot get too deep into conversations about margin, the association compellingly encourages integrators to recognize the value that they bring — and to price their offerings accordingly. One area where concern about value manifests itself is hardware margins. Looking at our survey data, the plurality response (margins of 21% to 30%) is relatively healthy — and it’s certainly positive to see a combined 16% of survey takers say their hardware margins exceed 30%. However, it’s somewhat troubling that 36% of respondents report margins of 20% or below — including a combined 11% who report margins of 10% or less.

“It’s hard to imagine how [companies at the very lowest end of margin reporting] are going to continue to be profitable in such a challenging market as we enter 2024 and beyond,” LeBlanc says candidly. His advice for integrators is clear: “Think more about the great value that you hopefully deliver to your customers and reflect that [in your pricing.]” Operating at extremely slim margins is very tenuous; integrators that do so might soon lose the ability to deliver the excellent outcomes that their customers depend on.

Editor’s Note: For another view of profit margins, leveraging data from nearly 1,000 commercial, residential and security integrators who use D-Tools Cloud Software-as-a-Service (SaaS) end-to-end business management solution, check out the accompanying post: “D-Tools Data Analyzes Profit Margins: How Do Yours Compare?”

Escalating Labor Costs

The cost of labor is one of the biggest drivers of ongoing conversations about project profitability. “It seems like very high percentages are reporting [these] higher labor rates,” LeBlanc observes. And, indeed, our research study finds exactly that. In last year’s survey, modest numbers of respondents reported higher hourly technician labor rates: $101 to $150 (44.9%), $151 to $200 (6%), and $200 or more (0%). By contrast, this year, we see rising percentages across all these categories: $101 to $150 (47.7%), $151 to $200 (15.9%), and $200 or more (6.8%).

“The top three labor-rate categories showed at least incremental — if not significant — growth this year,” LeBlanc confirms. “And it’s very consistent with what we’re hearing in the NSCA community.” This is a direct result not only of inflation but also of integrators competing for the same highly sought-after technical talent.

The Need for IT Expertise

Another driver of higher labor rates is integrators’ increased focus on bringing in IT-trained talent for more network-centric projects. There’s no doubt that, if traditional integrators want to transition to the tight client partnerships that master systems integrators enjoy, they need to focus on improving their in-house IT expertise. “It’s hard to overstate how important it [is] to focus on IT right now,” LeBlanc declares. When integration companies aren’t focused on increasing their IT capabilities, he says, it puts them at a competitive disadvantage. “Customer needs require integrators to elevate their ability to provide managed services and provide network-centric solutions,” LeBlanc explains. Indeed, any integrator that hopes to seize on the managed-services trends discussed earlier will require growth in their in-house IT expertise.

Another driver of higher labor rates is integrators’ increased focus on bringing in IT-trained talent for more network-centric projects. There’s no doubt that, if traditional integrators want to transition to the tight client partnerships that master systems integrators enjoy, they need to focus on improving their in-house IT expertise. “It’s hard to overstate how important it [is] to focus on IT right now,” LeBlanc declares. When integration companies aren’t focused on increasing their IT capabilities, he says, it puts them at a competitive disadvantage. “Customer needs require integrators to elevate their ability to provide managed services and provide network-centric solutions,” LeBlanc explains. Indeed, any integrator that hopes to seize on the managed-services trends discussed earlier will require growth in their in-house IT expertise.

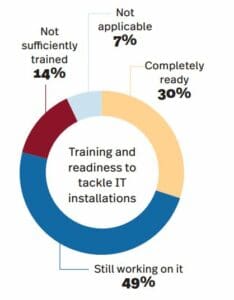

Our research study paints a mixed picture of integrators’ readiness to tackle IT-centric installations. Three in 10 respondents say that they’re completely ready for IT work, while another 49% say they’re still working on it. Just 14% rate their current status as not sufficiently trained. Curiously, another 7% indicate the question is not applicable to their business.

The question we posed is similar to one from NSCA’s Financial Analysis of the Industry, a research project whose pool of respondents tends to come from larger companies. Reflecting on those findings, LeBlanc says, “The average staff count dedicated to internal IT support is growing in most [integrator] categories. But the larger companies seem to be [putting] a much greater percentage of their overhead cost toward IT.”

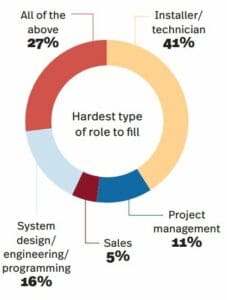

The Talent Question

Integrators’ escalating need to level up their in-house IT expertise further exacerbates the single biggest challenge that integration business owners face today: the lack of qualified job candidates. Our own research underlines this fact. In response to a question asking them to pick the three most concerning challenges their business faces in 2024, 91% of survey takers say that talent (i.e., finding, onboarding and retaining key employees) is among the most concerning. This far outpaces inflation/escalating costs (77%), post-pandemic company culture obstacles (40%) and supply chain (37%). NSCA’s Financial Analysis of the Industry, which likewise asked respondents about the biggest challenges they face, found exactly the same result. “It’s overwhelming how concerned companies are about being able to find and recruit talent in order to sustain their pipelines,” LeBlanc emphasizes. “It can’t be overstated how important it is for the industry to increase that pool of talent.”

Integrators’ escalating need to level up their in-house IT expertise further exacerbates the single biggest challenge that integration business owners face today: the lack of qualified job candidates. Our own research underlines this fact. In response to a question asking them to pick the three most concerning challenges their business faces in 2024, 91% of survey takers say that talent (i.e., finding, onboarding and retaining key employees) is among the most concerning. This far outpaces inflation/escalating costs (77%), post-pandemic company culture obstacles (40%) and supply chain (37%). NSCA’s Financial Analysis of the Industry, which likewise asked respondents about the biggest challenges they face, found exactly the same result. “It’s overwhelming how concerned companies are about being able to find and recruit talent in order to sustain their pipelines,” LeBlanc emphasizes. “It can’t be overstated how important it is for the industry to increase that pool of talent.”

If you’ve ever spoken to LeBlanc, you know that he frequently alludes to “The Bubble” in which our industry exists. It’s a means of describing the fact that so few people outside the AV industry know about the wonderful, lucrative career opportunities that our industry presents. He urges all AV stakeholders — integrators and vendors alike — to recruit outside traditional industry channels. By reaching outside of “The Bubble,” we can raise people’s awareness and seed our collective future. “We would like to make [things] a lot easier for people,” LeBlanc says. The best way to do that is to create more intentional pathways into our industry community.

Product availability — although not nearly as big of a challenge as it was a couple of years ago — remains something that’s front of mind for a lot of survey respondents. SIRISAKBOAKAEW/STOCK.ADOBE.COM

Other Economic and Societal Concerns

Although talent is clearly the biggest challenge right now, Wilson and LeBlanc say that NSCA leadership is hearing about multiple other concerns. They note, for example, that supply chain remains an extremely relevant topic. “Product availability — although it’s nothing like the challenge it was a couple of years ago — remains something that’s front of mind for a lot of NSCA member companies,” LeBlanc acknowledges. He hastens to add that issues with product procurement can lead to eroding margins and cash-flow issues, inhibiting project profitability and integrators’ bottom line. This is a real concern at a time when, for integrators whose financial leadership is not empowered to turn away “bad work,” any given project could harm, rather than help, that business’ balance sheet.

Wilson and LeBlanc also point to generalized economic anxiety — especially amid election year politics — as a potential inhibiting factor in the coming year. “There are a lot of things happening in the economy and around the globe that concern integrators,” LeBlanc explains. Many business owners are concerned about “…how [all this] might impact customers’ willingness to spend,” he adds. That’s one reason that NSCA, at its annual Business & Leadership Conference (BLC) in late February, is doubling down on addressing those concerns. Event organizers have invited Dr. Chris Kuehl, NSCA’s go-to economics guru, as well as other expert speakers, to address economic anxiety during the executive conference.

LeBlanc adds yet another puzzle to the list of those that integration business owners are trying to solve: What is the proper role for integrators as work culture and workplaces transform? For example, if an integration business, year after year, has earned significant revenue from building out corporate conference rooms and in-office signage networks, how does a distributed workforce affect their long-term viability? “In some cases, [it] means figuring out how to create such a productive and efficient in-office work environment that it really inspires team members to come into the office,” LeBlanc offers.

Moreover, company culture-focused integration business owners must figure out how to evolve their own internal workforces to meet post-pandemic customer and workforce demands. It can be challenging to negotiate a balance between the 24/7 outcome assurance that clients expect and team members’ reasonable expectation for a healthy work environment with great work/life balance.

Optimism Reigns Nonetheless

This year, the big picture is mixed although there is plenty of reason for optimism. 39561022 / stock.adobe.com

One might think the litany of challenges we’ve identified would have integrators feeling pessimistic. But, as we shared from the outset, most integrators see growth ahead and are sanguine about their company’s chances of profitability in 2024. “It’s a very good time to be an integrator,” LeBlanc declares, “because of how incredibly important the solutions that integrators provide to customers have become.” Pointing to AV, UC&C, monitoring, security, access control and surveillance — just to name a few — he adds that these essential solutions “…put [integrators] in an elevated role with their customers.” As LeBlanc puts it, “They can talk to them not just about the outcome of the solution but [also] about the outcome of their business and the outcome of their environment.”

Speaking metaphorically, running an integration business means a business owner is perpetually strapped into a roller coaster: There are peaks and valleys, and one can never be certain what the next twist will bring. “There are so many reasons to be optimistic,” LeBlanc states. “But we want companies to constantly be aware of the potential pitfalls.” Amid economic uncertainty and questions about project profitability, ongoing vigilance is warranted.

But, even so, Wilson and LeBlanc — and our research study respondents — clearly have a confident view of our collective prospects. LeBlanc summarizes the message perfectly, saying, “We feel really good going into 2024 for smart, forward-thinking integrators that are willing to empower their financial leadership to keep their operations in close check and make sure they’re making good decisions around cash flow and profitability.”