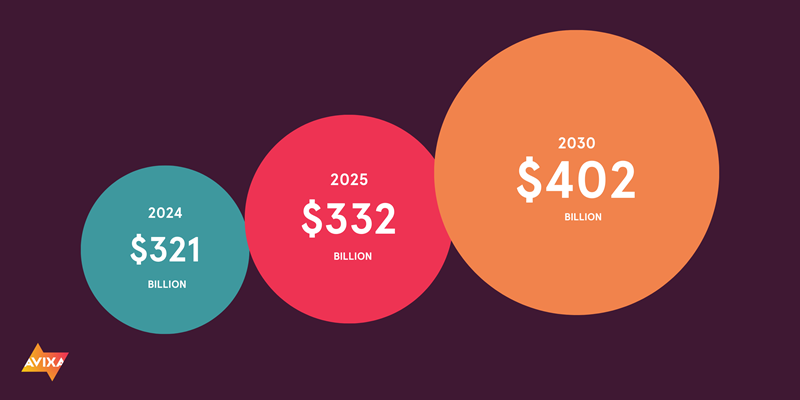

AVIXA’s Industry Outlook and Trends Analysis (IOTA) report has predicted that pro AV revenue will grow from $332 billion in 2025 to $402 billion by 2030. Previously, the IOTA predicted market growth to reach $325 billion in 2024, but growth was slower than previously predicted, reaching $321 billion instead. However, the pro AV industry remains resilient, with a forecasted increase of $70 billion over the next five years, according to the report.

IOTA Report Insights

AVIXA notes that the IOTA report is a comprehensive analysis of the pro AV market, using data from the previous five years and input from various market stakeholders. By providing a snapshot of end user spending, the report presents data on the size of the pro AV industry with a global perspective, segmented by geography, vertical markets, solution areas and product categories.

Based on discussions with industry experts along with observations of macroeconomic pressures, the previous 5-year projection of a 5.3% growth was revised to 3.9%. Even with this notable decrease in the growth rate due to the dampening effect of uncertainty in tariffs, geopolitics, and high interest rates, pro AV is expected to outpace the global GDP growth by 0.8 percentage points, the report reveals.

“The data highlights that the pro AV industry remains well positioned for long-term success even as we navigate a more cautious growth environment. Strategic investment in emerging technologies, regional diversification, and cross-industry collaborations will be key to unlocking more opportunities in the future,” says Sean Wargo, vice president of market insights, AVIXA. “While the sector continues to outperform global GDP, the pace of expansion has slowed, reflecting a shift from post-pandemic recovery to more stabilized, experience-driven markets — such as live events, retail, venues and hospitality.”

Growth Opportunities

Two forces continue to shape and drive demand in the pro AV industry: the hybrid workplace and the experience economy. By investing in AV tech to enhance engagement and collaboration in and out of the office, businesses are fostering a symbiotic relationship between workplace transformation and entertainment-driven experiences.

According to the IOTA report, India has emerged as the standout performer in the Asia-Pacific (APAC) region, which remains the engine of pro AV growth. Previously a position led by China over last few years, India’s rise to the lead performer emerged from an increase in infrastructure investment and a growing need for immersive technology-enabled experiences. Other regions experiencing high growth are the Middle East and Latin America, the report reveals.

AI and AV-over-IP Also Lead The Charge

According to AVIXA, the pro AV industry also continues to evolve through innovations in AV experiences. Key innovations are four technologies: AV-over-IP, software and cloud, artificial intelligence (AI), and extended reality (XR). Now a mainstream aspect of AV installations, AV-over-IP enables content distribution and system control via IP networks. Market drivers are operation efficiency, cost reduction and immersive experiences, says the IOTA report.

Software and cloud are increasingly central to AV operations, enabling remote management and scalability. AI is enhancing system intelligence, aiding in design, programming, and labor augmentation, while XR is gaining traction in entertainment, retail, and education. For products, content management hardware and services dominate. Standalone software, especially AI-powered tools, is the fastest-growing category. According to the IOTA report, this trend highlights a broader shift toward value-added services and intelligent infrastructure.

Other Emerging Trends

The corporate sector continues to be the largest buyer segment, although its growth is slowing while government, military and energy, and utilities are all accelerating. This reflects recession-resilient investment patterns.

From an AV solutions perspective, conferencing and collaboration tech still leads, but security/surveillance and broadcast AV are rapidly climbing the ranks, states AVIXA. Broadcast AV has now become the second largest solution area behind conferencing and collaboration technologies. According to the report, this rise shows the growing interest among enterprises in developing video content creation capabilities. It also offers another facet of the experience economy in which audiences are engaged on both digital platforms and in-person, which leads to companies viewing corporate events as capturable and shareable content.

For more information about the 2025 Industry Outlook and Trends Analysis (IOTA), visit AVIXA.org/IOTA.